Tools are a gift from God; machines the Devil. ~ Nicolás Gómez Dávila

This post will mirror some of my previous posts and will again compare two credit and accountancy ledger systems, the current and five centuries old fractional reserve banking and double-entry bookkeeping ledger system against the distributed and deflationary credit system and ledger network of Bitcoin, and will extensively discuss how the issue of credit has profound effects on the relationship between capital and labour, how inflation and centralization of capital leads to the rise of automation and machination at the expense of labour, and how deflation leads to decentralization and the diminishing of automation and machination to the benefit of a labour intensive economy… The Rise of Bitcoin, The Fall Of The Machines is at its essence the simple theoretical conclusion arrived at once you have an appreciation of the powers of the purchasing power of credit and money on the relationship between capital and labour, and how it has profound consequences and effects on the structure of economies and economics…

Inflation – Definition

In the dumbed down world of modern mechanical economics and econometrics the original meaning and definition of nearly everything has been co-opted and corrupted by what Orwell called Newspeak, that is the twisting and debasement of words to psychologically and unconsciously trigger the exact opposite of their original meaning (doublethink), and so this has been done with the term “Inflation“… Inflation nowadays implies a rise in the cost of prices of goods and services that is the causal effect and symptom of the real and traditional and classical meaning of inflation which was an increase in the money supply relative to goods and services exchanged for, even simpler and increase in the relative money supply of the economy…

Inflation – An Introduction

My blog from day one has been about money and credit and their historical symbiosis, as hard physical commodity (gold and silver) or by credit or trust based ledgers for local exchange or mental barter as I would call it, or by credit based ledgers for leveraging the underlying commodity money (gold and silver), otherwise stated as the history of banking… Money and credit are eternally intertwined and complimentary, but can also exist to dilute or manipulate each other if, and this is a critical if, they are treated by exchanging populations (economies) as one in the same thing… Money (gold and silver) are mined and not printed, but credit either by local barter ledgers or by credit derivative ledgers of money (banking) can be printed and issued cost free because they are substitutes issued by a TRUSTED counter-party and middleman and should evidently be based on trust, even the physical banknote denoting money only as trusted as his banker… The advantage of gold and silver over credit is that it is a physical commodity that is outside of derivatives and of mental barter, and does not require trust (in a conventional manner) because it is a physical commodity outside of the trust of counter-parties… Money is real, credit is a manifestation of trust… So the ultimate goal of a credit derivative system (banking) is to usurp the superiority of money by hoarding and leveraging it by the use of ledgers and credit, and it is only after six years of hard research I have come to this reality, banking is and always has been a scam to defraud society…

A conspiratorial view of history I’ve yet to research properly – it would seem to support my growing view that the secret technology behind civilization is purity of precious metals, and the knowledge and expertise in minting of sound coinage – The Secrets Known Only To The Inner Elites

Inflation – The Early History (500 BC – 500 AD)

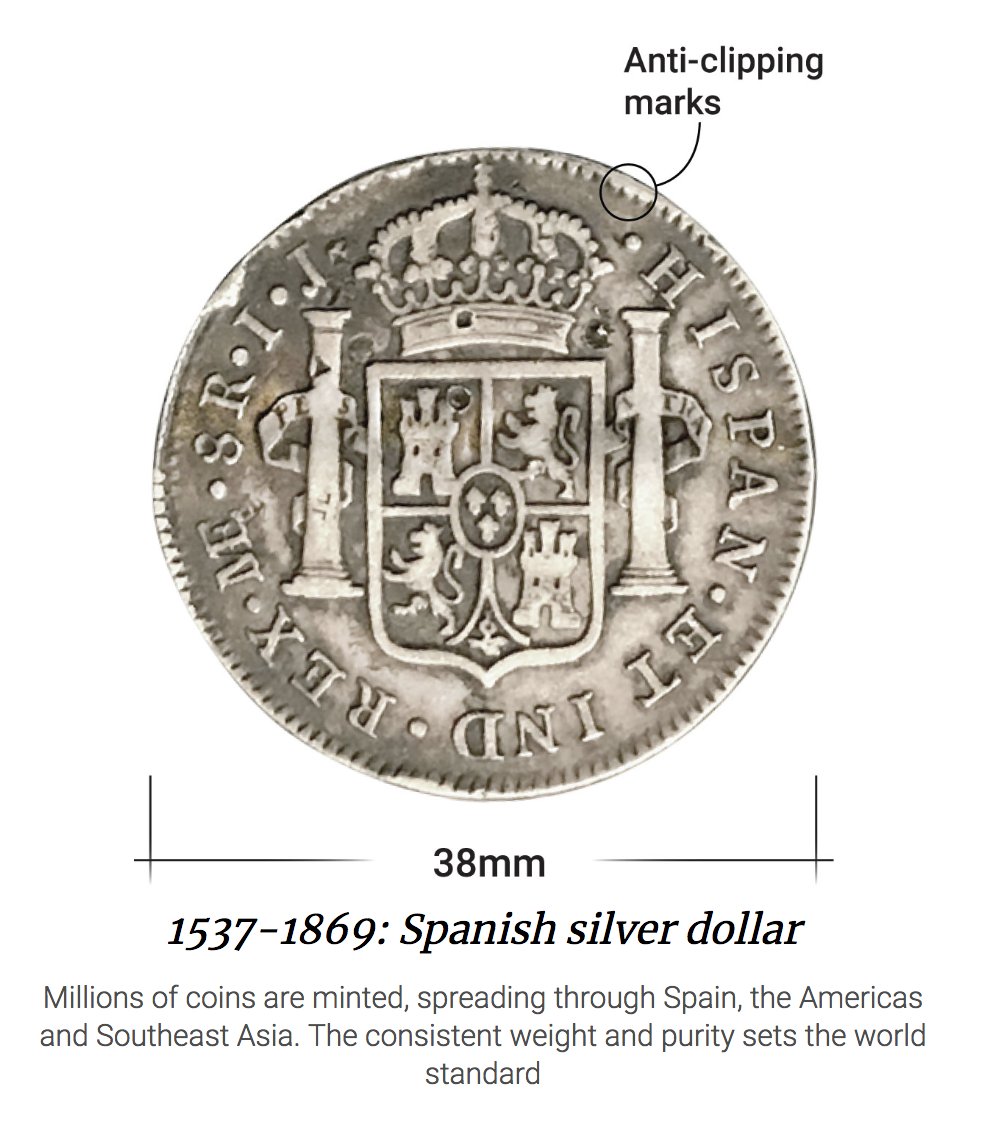

I described above how money was a sovereign commodity that was outside of trust and the counter-party issues inherent within a credit (trust based) system in the conventional manner, however there was also an unconventional manner which when you look into monetary history dawns upon you was all too conventional and in that way bringing up the same counter-party trust issues as credit, in inflating money by introducing inferior base metals into gold and silver coins in order to dilute the value by weight, or alternatively to debase by what was known as coin clipping, to reduce the weight of existing coins and to mint new coins with the clippings… In both cases the goal is to get something for less, by either creating new money out of the existing supply (clipping) or flat out creating more gold and silver by debasing the coinage with inferior metals of far less scarcity, value and cost of production, however it should be clear that unlike the issue of credit it cannot ever come at free cost… Messing with precious metals requires skill and expertise and know how, requires smelting and coining plants, furnaces, bellows, charcoal and infrastructure, and was dangerous on more than one level… The penalties for debasement in the ancient world usually included death for a reason, that inflation and debasement are at their essence defrauding the rest of the population of the value of their goods and services, by meddling with the store of value, medium of exchange and unit account they used to exchange and set the values of gold and silver… Debasement had severe consequences and was not that easy at the local level as the smith or mint issuing dodgy coins would soon bear the wrath of the public being defrauded, however the debasement of the Babylonian, Persian, Athenian, Macedonian, and Roman civilizations and Empires was also the collapse of those civilizations and Empires and is empirically recorded history, so Thier’s Law is the law of free markets and the rise of civilizations when the purest, most trusted, most desired, most honest, and therefore the strongest and indeed international monies develop (Persian Daric – gold, Greek Tetradrachm – silver, Macedonian Stater – silver, and Roman Denarius – silver) attracting international trade, inflows of precious metals and the construction of ports and cities, architecture and infrastructure, art, music and literature, philosophy, science and scientific discoveries and the advance of technology, and of books, libraries and literacy… When the civilization has overextended and its ruling class corrupt, greedy, entitled and psychopathic, we have the flipside of Thier’s Law which is Gresham’s Law, when the honest money is hoarded and the increasingly corrupt money is circulated instead, diminishing and debasing value and trade, increasingly shunned in exchange as the influence and reach of the currency shrinks internationally, and creates increasing poverty, debt, cultural and moral debasement, decadence and pure insanity as once great civilizations head toward the dustbin of history… From the five hundred years Before Christ to the five hundred years after Christ, the Persian, Athenian, Macedonian, and Roman Civilizations did not rise by “accident” and their Empires did not debase into collapse by “accident”… It was all about the money stupid!

Feudalism – Credit And Money (500 AD – 1500 AD)

Following the collapse of the Western Roman Empire was a millennial supercycle of feudalism, a highly parochial, localized and tight knit social order based on blood, labour and soil, and the division of society between property owners (kings, nobles, freemen) and property renters (serfs) with the latter producing a tax (rent) for the landowners and with every chance of being able to save for the future and eventually pull themselves up the social ladder to property and liberty… Serfdom was the social safety net of the middle ages for the weakest and most dependent in society in producing for himself and his lord and was a hand up and not a hand out, the opposite of today’s taxation and voting gangbang by welfare dependents of the taxpaying public… From the fall of Rome (Circa 500 AD) to the Reformation (Circa 1500 AD) Feudalism was able to maintain a highly fractured and decentralized social order throughout Western Europe and even though there were numerous rivalries (Holy Roman Empire and The Church) and skirmishing for power and control and the centralization of the European Continent under one power and the new Rome, this never happened and I have spent many an hour wondering and pondering how come? How was nobody able to dominate the West for a whole millennium in time? I am sympathetic to the notion that the libertarian doctrine of Christianity and the Christianization of Europe’s many diverse and disparate tribes post Rome was an unifying force and allowed the development of a broad framework for laws and ethics and property ownership, Common Law, Canon Law or Natural Law, but what I am starting to appreciate is that it was the monetary economics of Europe that was crucial, or more crucially the shortages of money that existed in many parts of Medieval Europe that necessitated the use of local barter and credit and debt ledgers, or simpler still, tally sticks… I’m simply guessing at this point that post Rome exchange and trade and therefore the precious metals that powered both moved East and toward Eurasian trade, leaving the West cut off and making do with credit ledgers based on local trust and trade…

The fact that no-one city state or nation was able to refine or standardize and redefine a monetary unit in either gold or silver that would underpin the rise of a new and centralized “civilization” allowed Europe to blossom into a beautiful patchwork of unique and distinct micro-economies thousands on end, even though was an unifying religion and theology there was no unifying gold or silver standard and therefore extensive use of barter credit ledgers that culminated with the brilliant and virtually tamper and fraud proof split tally ledger, with said stick being split in two (stock and foil) with a copy each for exchanging parties, therefore eliminating counter-party risk, fraud, and the debasement possible with gold and silver coinage…

Europe at 1300 AD – Late Middle Ages

As these tally sticks only have value to a micro and highly localized economy (and does not scale regionally or continental) then imports and the need for imports are curtailed and little is exported again leading to distinction and diversity of endless villages, towns and city states that was a Medieval Europe based upon labour and intensely rich in art, architecture and literature that is completely ignored by “Enlightenment Thinkers”… The fraud proof localism of the Middle Ages is the closest thing we ever got to a free market, until the Bitcoin split tally stick invented in 2009…

Making Europe Great Again – The Medieval Split Tally Ledger and forerunner of Bitcoin and Distributed Ledger Technology

Inflation And The New World (Spain 1500 AD)

One more inflationary phenomenon worthy of discussion is not an inflation by debasement of the existing money but a sudden supply and debasement of the existing money from an infusion of fresh and honest money, as was observed and documented by the great Martín de Azpilcueta (1491-1586) and others of the Renaissance School of Salamanca, and the early forerunners of both the Austrian School and Milton Friedman’s Monetarism… Azpilcueta lived at the beginnings of the Spanish Habsburg Empire which on the back of the Spanish Silver Dollar served as the world’s first reserve currency in the Seventeenth And Eighteenth Centuries, with vast new inflows of precious metals from the New World that created rampant inflation in certain Spanish localities and debased the value of the existing population’s money with the prices of goods and services, land and property increasing to account for the additional gold and silver spent into circulation presumably by the Habsburgs and returning Conquistadors… However unlike debasement by corrupting the money supply this is debasement by honest money and so this is a temporary aberration that stimulates corrective free market action as this excess of money is still desired by exchanging populations not suffering from inflation and exporters from outside, there exists an arbitrage trade to drain the monetary excesses by stimulating imports, thus the exchanging population suffering are incentivized to consume more goods and services from outside with the money moving in the other direction and outside of local circulation, for as long as until money and economy are back in deflationary and purchasing power increasing civilizational balance…

Probably the greatest reserve currency of history – The Spanish Silver Peso (The World’s First Reserve Currency – Pieces Of Eight HT @smaulgld)

Inflation – From Money To Credit (Post 1500 AD)

As I have described in many past posts the biggest technological revolution of the last five centuries was the Double Entry Book-keeping Ledger, the origins of modern banking, facilitator of Modern Capitalism, the Renaissance, The Protestant Reformation, The Divine Rights Of Kings, The Nation State, Central Banking, Two World Wars and the destruction of the West and the world… From small acorns mighty oak trees with branches worldwide have grown, evolved, metastasized, cancered, corrupted, and destroyed liberty of life and property, so as nothing is sacred… But as corrupted as utterly unhinged centralized double entry book-keeping has become from its precious metals underpinnings, the Origin of Banking cannot happen overnight and it cannot really flourish if the money is ALREADY corrupted, in other words it requires honest money and free markets and indeed you will find that the Renaissance and modern banking originated in Northern Italy for a reason, the reasons being the Florentine Florin (gold), Venetian Ducat (gold) and Sequin (gold), the Dollars of The Middle Ages, and this phenomenon further reinforces the above observations from Spain that the School of Salamanca documented at the beginning of the Spanish Silver Age, with the rise of reserve currency status is the inflow of precious metals and inflation which I believe creates the conditions for a secondary industry for money, borrowing and lending and the arbitrage on money and the price of money (interest rates), in other words the rise of banking… Banking as a derivative layer can only thrive by beginning its existence in a free and flourishing market (taking in deposits of money and paying a deposit rate of interest while also lending out money and charging a lending rate of interest, capturing the spread between both) because what the banker proposes when acting as a trusted intermediary of money and credit, is giving you a paper ticket (banknote) or leather and ink inscribed document (Bills of Exchange) or anything that denotes and derives its value from the underlying gold and silver, a credit and faith based belief in the honesty and integrity of the banker and the ledger he controls… So it should be self evident that the rise of bankers in the late middle ages had honest and hardworking beginnings as did those of the monarchs and royal houses and families of Europe, BEFORE claiming the monopolistic and Divine Right that the totalitarian doctrine of Protestantism injected into monarchy of rule by absolutism, legislation, taxation and despotism… It is legislation in combination with money and the parasitic symbiosis between national monarchs and bankers that sows the seeds of the Eighteenth and Ninetenth Centuries, especially in England and Britain, as I will get to later on…

Inflation – A Simple Thought Experiment

The invention of the double-entry book-keeping ledger and the scaling of a paper derivative layer for gold and silver reserves introduces a different dimension to inflation and debasement in that it can be issued at free cost and so fraud becomes essentially free and exponentially dangerous, but beginning as a flourishing local and later domestic credit system with a gold or silver standard used in international and continental trade, banking starts out as the monkey and only becomes the organ grinder centuries down the line and by slow evolution, for the epic scam that is printing currency takes time, patience and cunning…

The thought experiment… Imagine an economy of a hundred people who all utilize one local bank and have each a thousand pounds (Sterling) of savings in the same bank, and a banker that has built up enough trust over time among his community so that his banknotes have superseded the exchange of the underlying precious metals and totals a hundred thousand pounds worth of inked paper banknotes (cash)… The banker now has a gullible population equating paper with metal and one far cheaper to counterfeit than the other, so lets say he fires up his printing press and prints one hundred thousand pounds worth of additional paper notes, he has inflated or doubled the currency supply relative to the underlying precious metals and goods, services, labour, land and property of this micro economy… But it should be obvious that the banker does not seek to enrich himself in currency notes because he has created them from paper and ink at virtually zero cost so the notes themselves are worthless to him, what he values are the goods, services, labour, land and property of the economy that trusts the currency to exchange, so this is the essence of fractional reserve banking or to use a more modern term rehypothecation, creating more claims upon an underlying asset that there are actual assets, or simply fraud that has to in my opinion carry no less than the death penalty because it really is the most shady and disgusting of crimes… So the next step is to release this currency into the economy, in exchange for the goods, services, labour, land and property, and thus getting REAL stuff for free, which should evidently lead to a centralization of the economy and the means of production as the banker is in essence buying up the economy for free, that as far as I am concerned is the evil purpose of banking and the exploitation and debasement of the value of the whole economy through the corruption of currency, enriching the controllers by debasing the public… This is fraud, this is debt, and this is communism, and intriguingly central banking (operated by socialists instead of capitalists) was the foundation for Marxism and Leninism in bringing about the epoch of socialism and the destruction of capitalism… Socialism had the most curious financial backers…

Inflation And Purchasing Power

In this thought experiment the banker has doubled the credit supply while the gold and silver in the bank vault and the goods, services, labour, land and property of the micro economy remain unchanged, he has also been able to exchange his zero cost banknotes for REAL labour, goods, services and property, he has enriched himself by debasing the rest of the economy, and that the prices of goods, services, labour, land and property also must eventually double over time to absorb the bankers naked fraud, so that purchasing power of the circulating currency will have to eventually drop by half… As the banker who has created this credit out of thin air gets to spend the money first he gets the original purchasing power of everyone else’s stuff, and it is only as this excess currency continues to circulate does it debase the exchanging economy with increasing prices and it will be those furthest away from the printing press, the poorest and most destitute in society that will get the currency last and will pay the full price for the inflationary debasement of goods and services, so credit printing or fractional reserve banking is a slow motion wealth transfer from the people to the banker, debasing all for the benefit of the few, and a tax on the poorest in society levied by the richest… The breeding ground for inequality…

Inflation And Interest Rates

The secondary effect of credit printing is in creating temporal mis-allocations, more simply stated a mis-allocation in time by bringing forward artificial demand from the future, it also messes with the price or the cost of money, or even simpler interest rates… Interest rates in the free market would be set at the margins between supply and demand, between savers and lenders with bankers as the intermediaries, with the interest rates on both saving and lending dependent on the amount of real money (gold and silver) out in circulation… Increasing interest rates and cost of money would indicate a scarcity of money that would stimulate short term production and inhibit consumption while falling interest rates and cost of money would indicate an abundance of money stimulating consumption and investment for longer term production, so interest rates play a critical part in a free economy and determine the degree of future orientation of the economy, scarcity of money indicating the need for productivity and a shorter term high time preference, with abundance of money indicating a longer term low time preference allowing the market to develop more long term consumption projects and expanded division of labour…

Fractional reserve banking or printing additional credit over and above base money (gold and silver in the bank vaults) as both are inter-changeable, distorts this critical market signal and fools the market into believing that money is indeed ample and that the investment structure can be developed more longer term that in fact it can in reality, so more economic projects are started than the underlying economy can complete in the long run, which is also known as the business cycle that I spent an entire previous post explaining… However as I have already explained the banker is in fact creating something out of nothing, debt out of wealth, wine out of water, and prosperity out of fraud, so fractional reserve banking and the business cycle boom and bust are temporary hallucinations that cannot really last long because the banker is running a confidence scheme that is based upon trust, the trust in his fraudulent issue of credit… As the process of fractional reserve banking extends and pretends by issuing this fraudulent credit and the micro economy exchanging is progressively debased and made poorer, naturally the peasants over time will begin to figure things out, they figure that their lives have only become poorer since this imitation currency was issued and their sights will eventually move to the banker and his crooked currency, forcing the banker sooner or later to start to rein in the excesses of his fraud, which precedes the bust of the credit/business cycle… As the banker slows his money printing then interest rates start increasing which starts to signal the desire for the market to stop consumption and investment and to start saving and hoarding money which is effectively forced by the credit contraction and the increasing scarcities of currency which has traditionally and historically manifested as the bursting of bubbles (Post-Reformation, whether Tulip, South Sea or Mississippi) and more persistently in the increasingly unhinged business cycles of the Eighteenth and Nineteenth Centuries observed by the British Currency School and the basis for Ludwig von Mises’ development of business cycle theory also known as Austrian Business Cycle Theory or ABCT…

The Bust cycle and the sudden drying up of currency cuts financing to the surplus and unsustainable projects juiced by fractional reserves and the artificial suppression of interest rates and time preference inducing over consumption, and why so many businesses, ventures and investment projects go bankrupt at the same time with the side effects of capital loss and unemployment, as the fraud becomes apparent… It is here that the banker should be sweating bullets as it his currency that is put in the spotlight as the economy starts to question exactly what is going on around them… Even though banknotes have become interchangeable with precious metals the flipside of this exorbitant privilege in the boom stage is the exorbitant liability in the bust stage in that a fearful and whispering conspiracy hungry public start coming in to the bank to redeem the gold and silver in exchange for the banknotes whose trust they are now questioning… This is also called a bank run and history is replete with them, and as the banker in the above thought experiment created an additional hundred thousand pounds of paper notes out of nothing he obviously does not have the silver to give back in exchange for all of them, there are only so many redeemers of precious metals that can be satisfied before the vaults are empty and the crime is fully exposed… The banker’s next logical step would be to suspend withdrawals and impose a permanent bank holiday which in turn would only make a panicking public distrust the banker even more and with no prospect of ever redeeming the metals from the bank, the paper banknotes of whoever is still holding them become worthless nearly instantly as trust in credit evaporates and the economy seeks the security and immutability of precious metals, fearfulness incentivizing hoarding and increased production as interest rates rise correcting the mis-allocations of capital…

This is the basic and very brief description of how operating on fractional reserves weaponizes fraud and distorts interest rates and time preference and fabricates a credit and business cycle boom and bust, and by default increases inequality between banker and banked but that the banker is also inherently weak and fragile in a free market economy and that this fraudulent hallucination cannot last for a prolonged period of time with the societal penalties also including getting shunned, lynched, murdered (this would be my choice), or hounded out of the economy, his future ultimately in the hands of those he has fleeced… Money holds supremacy over credit when the economy is left to its own devices however the Protestant Reformation and the rise of Protestantism and Absolutist Monarchism and the division of Europe during the Religious Wars (1500-1650 AD) that was funded by the money lenders of Northern Italy throughout the Sixteenth and Seventeenth Centuries, brought Nation State and King and money lenders and bankers together in a parasitic symbiosis that would unleash the cancer of a National Bank and Central Banking on the world, weaponizing fraud, inequality, industrialism and the rise of the machines and the disenfranchising of labour through the mechanism of purchasing power… The Industrial Revolution of the Eighteenth and Nineteenth Centuries is coming into view…

Inflation And Legislation – The National Bank Monopoly

As I discussed at length in my last post on Gold And The Blockchain Central Banking spawned under Protestant Monarchies, the Sveriges Riksbank in the Sweden of 1668 being the first, however the later and far more important for discussing the relationship between National Banking and industrialism, is England and the Bank of England… Established in 1694 just six short years after the so-called Glorious Revolution of 1688 when William Of Orange overthrew Catholic James II (James VI in Scotland) and the rule of Protestantism re-installed in Britain, as like everything else in the history of banking it was a slow evolution throughout the Eighteenth Century and the slow seeding of the inflation and the industrialism of the Nineteenth Century and the Empire on which the sun would never set… How and why did this incestuous relationship grow?

It should be pretty obvious why a king would desire a Central Bank, a lender of last resort to finance the wars and welfare payments of standing armies and welfare stipends for a royal entourage of freeloaders domestically, and navies needed for foreign acquisition of territory, citizens and loot in the realms of foreign policy and pillage… It should also be pretty obvious why moneylenders would desire this monopoly privilege issued by a reigning monarch, they then get access through despotic monarchism and legislation and taxation of the nation to something that they could never be granted in a free market, that is indirect (and eventually direct) control of a national economy through currency issue, and fractional reserve banking and lending and national scale interest rate manipulation and business cycles… The inequalities that are to build up slowly during the Eighteenth Century will lead to the soaring inequality of the Nineteenth Century as a by-product of the soaring fractional reserve credit and business cycles that was the source of Marx’ critique of Capitalism and the centre-point of his (and Engels) Communist Manifesto (1848) in advocating for a centralized state apparatus (Socialism/Communism) to overthrow the private banking system that was enriching capitalists at the expense of the workers… However way you look at it the increasing tug of war between capitalism (Liberalism) and socialism (Marxism) during the latter half of the Nineteenth Century was over the issue of money and credit, because whoever controls the money drives history…

The Ten Commandments Of Communism

Inflation In History – The Curious Case Of The Industrial Revolution

Inflation > Capital Mis-Allocation > Industrialization > Population BOOOOOM

The Industrial Revolution began in England in the last half of the Eighteenth Century and was complete by the end of the first half of the Nineteenth Century, and a little over a century after the establishment and evolution of the first modern national central banking system, and also “happened” to precede a meteoric population boom unprecedented in human history, it also lead to the industrialization of agriculture and manufacturing and the rise of the machines to radically increase productivity to service this population boom at the expense and debasement of the traditional and labour intensive craft economy, with mass population shifts from rural areas as the machines made their labour redundant, to work the machines in the new industrial towns of England, Wales and Scotland… Is all this just a co-incidence theory of history or is it (as I hope I have explained so far in this post) that money drives history and that the controllers of money and credit in England from the end of the Seventeenth Century was the Central Bank of England and this historical quirk is far from a co-incidence?

To give my take on the above chart the population of England stayed steadily under ten million for seven hundred years throughout the middle ages and the feudal system of political decentralization largely maintained by the split tally fraud proof ledger system of local exchange and barter, and when the credit and money supplies are scarce, stable and in balance with economic and population growth, and a low time preference in general reflected with birth and death demographics stable which helped maintain the feudal social structure of labour intensivity… From 1800 on this historical relationship breaks, population growth explodes reflecting increased time preference and more short term thinking that I would argue would only be due to a drop in the purchasing power of labour incentivizing the increase in production of children and future labour to maintain the individual family’s inter-generational standard of living in a rapidly disrupting and fracturing labour market, most famously enshrined in history as the Luddite Movement and the sabotaging of the machines that were overthrowing their ancestral way of life, and is still the sneering and mocking cry used against anyone who questions Progress, Enlightenment and Technology…

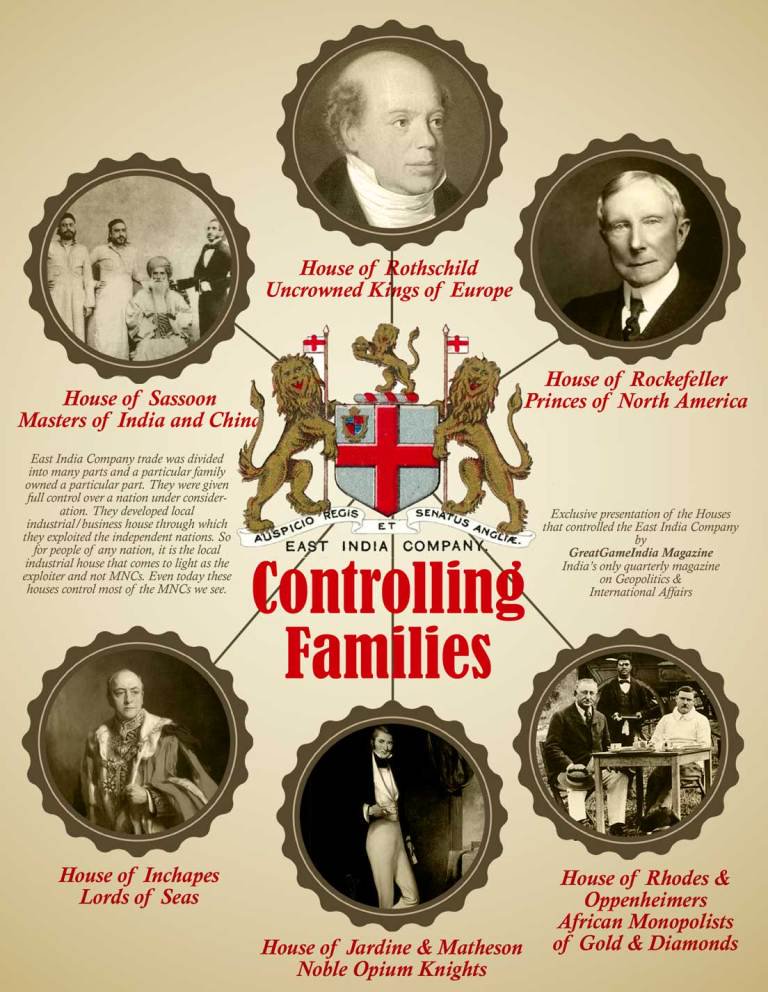

Industrialization and domestic inflation and reductions in purchasing power/standards of living also “co-incide” with one of the biggest and longest lasting wars in history, the Napoleonic Wars (funded on both sides by central banks and banksters) and the international fight for hegemony between England and France that lasted twelve years (1803-1815), after which Britannia ruled the waves on the international rise of Pound Sterling that supplanted the Spanish Silver Dollar as the World Reserve Currency of the Nineteenth Century, while further centralizing and inflating the domestic credit supply with monopoly legal tender laws following the Peel Act of 1844 and when the private banking system of the United Kingdom was fully nationalized (while remaining in private hands) and subject to the legal tender laws and exclusive monopoly of the Bank of England, the licence to print the currency of the United Kingdom controlled by a small cabal of anonymous bankers in the City of London, and given its intellectual cover by the Classical Liberals, Whig Theorists and Enlightenment Thinkers who lauded free markets and free trade, the “freedom” of a National Bank and private corporation financing the greatness of the British Empire, which included the predominantly Jewish run Western Transatlantic Slave Trade in the North and South American Colonies (abolished by Britain in 1837), and in the East the chartered trade monopoly of the East India Company over The Opium Trade that ethnically cleansed and starved Indians by the millions in planting, growing and harvesting the opium before shipping it to Southern China to addict the Chinese to opium so that the Empire could empty China of her silver, among so many innumerable crimes against humanity committed by this handful of extremely wealthy and powerful Ashkenazi Jewish bankers and merchants of death… For the sins of a small cabal of banking and royal families in the pursuit of greed and power, Europeans must carry this “white” guilt of the brutal history of “colonialism”… Paraphrasing Napoleon, history is a set of lies agreed upon…

The British Empire basically consists of two chartered monopolies, the Bank of England and The East India Company (1600-1874) – Muh Free Trade

The Economics of Credit, Capital And Labour

My earlier thought experiment demonstrated how inflation (from now on I will be discussing inflation exclusively in terms of credit creation) transfers valuable wealth and capital from the public by means of creation of fraudulent and worthless banker credit, and that the banker enriches himself by centralizing and hoarding ill gotten land and property, and in the case of fractional reserve lending extracts labour for free from the poor debt serfs tempted and conned into borrowing and in the worse case scenario receives the debtors collateral in a case of default… This centralization also means a rising inequality as the banking system granted a national monopoly or central bank can effectively buy up the rest of the economy for free, the less than 1% is able to exploit the over 99% for the sole purpose of enrichment in property as this is what cannot be printed from thin air, thus bankers become large land and property owners within society and they increasingly direct the economy and funding flows as they spend the currency first and at the old purchasing power while the weakest links (and furthest away from the printing press) would be the general public, or the labour component of the economy… Credit centralizes and inflates the value of capital while devaluing the value and purchasing power of the labour of society, and an economy that is being debased by credit printing becomes less independent and more dependent because capital and property are becoming more expensive (and in fewer and fewer hands) while labour (in more and more hands) is getting devalued against it … As labour is the common man, it is also at the end of the queue in paying for the enrichment of crediteers and thus capital inflates its unnatural and corrupt supremacy over labour creating the inequality that the Classical Liberals and most modern economists (even Austrians) will tell you is a pure natural supremacy, and was the intellectual cover for the Industrial Revolution, Capitalism and all the industrial world wars since… As labour cannot any longer afford capital or afford the maintenance of capital they have to give it up and enter what I would deem the realm of serfdom that is renting your property and renting your labour, as self employment property ownership and what I would call liberty are subsumed fraudulently by working for a boss and leasing his means of production… For all the talk and infamy of medieval Feudal serfdom and the exploitation by the lord of his serfs, the truth is as usual the opposite, medieval Europe was ruled in many parts and ages by the fraudproof and deflationary split tally ledger system which in fact reduced inequality (by protecting the purchasing power of labour and eliminating fraud and usury), and it is only since the Reformation and Central Banking that inequality and serfdom has exploded to what it is today where the top 1% owns half the world’s wealth…

Under inflation therefore we should expect to find a reducing trend of self employment, property ownership and small business, and an increasing trend of employer and employee, rentier and renter, and big and bigger corporations, a centralization of the means of production and increasing income and wealth inequality… This general debasement and slow motion strip mining of society creates shortages of capital and labour in financing the usurious standards of living of bankers and unleashes economic darwinism whence capitalists and workers hostage to the necessary component and inherent nature of competition for survival in a society getting poorer, will force productivity growth and industrialization and mis-allocations of capital (always at the expense of labour) and when this fraudulent economic structure is at the mercy of revolutionary (centralizing) technology…

Industrialization I argue is NOT a measure of wealth but of poverty engineered by fractional reserve banking and fraud, industrialism replacing labourism, machines replacing tools, mass production replacing handcrafting, factories replacing workshops, unions replacing guilds, renters replacing owners, serfs replacing free men, centralization replacing decentralization, and all of this as the side effects and symptoms of fraudulent credit replacing honest and sound money… Industrialism, automation and robotization, the capital structure and the population booms it has created since the Nineteenth Century are mis-allocations of capital and labour and will be reversed (in one way or another) once we return to honest and deflationary money and credit, that I believe are imminent and will elaborate on later on in this post…

20th Century Inflation – Industrial Banking, Industrial War, Industrial Economy

The “success” of the Bank of England (for the Elites) was the template for the industrialization of the West by the banking cartels, most notably in Banque du France from 1800 (to fund the Napoleonic Wars), the German Reichsbank from 1876 (following Bismarck’s founding of the German Empire in 1871) and fatefully for America with the Federal Reserve Act of 1913 finishing the process of the centralization and enslavement of America that had started with the Northern War of Aggression (also called the “Civil War“), the major world powers were equipped with the credit printing apparatus to inflate the currency supply effectively suspending the international gold standard (and a six month long war) and unleashed a four year long war that destroyed Western Civilization… The First World War foisted conscription (kidnapping), taxes, rationing, poverty, crime, and INDUSTRIAL WAR and Post Traumatic Stress Disorder on the passive and innocent European public, genocided a generation of Europe’s young men from fatherhood and robbed a generation of parents of their sons, virtually conscripted the female population in the cities into the war factories in what was the first socially engineered fracturing of the family unit on a mass scale… War you see is the most effective way of weakening and abolishing the property rights of citizens in any country and a World War financed by industrial banks destroyed the property rights of the West and beyond and exponentially accelerated the centralization and domination and extortion of the West, war is a tool waged by genocidal banking elites and the collateral damage is us… Walk around any cemetery in any village or town in Europe and you will find a memorial to the dead of both world wars, but the second only came because of the first, the end of civilization and the beginning of a century of decivilizing Democracy, the Great War was a disaster of epic proportions created by the central bank magicians and borne by the public in blood, sweat and so many heartbreaking tears…

As the British had smacked down the emergence and rise of Napoleon’s French Empire at the beginning of the Nineteenth Century, so the late entry of Germany into central bank capitalism with Bismarck’s Empire required another smack down by the Anglo-American Empire at the start of the Twentieth Century, the fallout of the Great War was laying the foundations for the Second World War with the extinguishing of three out of four of the European Continent’s ruling monarchical dynasties and the Ottoman Empire that unleashed a new chaos upon the volatile middle east, and Democracy was unleashed upon the West, from the internationalist communism that took power through the Wall Street backed Bolsheviks in Russia and its threat of encroachment into a post war and revolutionary teetering Western Europe that subsequently fueled the rise of the Fascist and National Socialist counter-movements of Mussolini, Hitler and Franco in the 1930’s, but the real fallout of the Great War was the destruction of Europe (especially Germany which was the object of the Anglo American Cabal) and leaving America as the world’s only real superpower, and the transition of world currency status from the imploding British Empire’s Sterling to the US Dollar (gold) would be completed at the end of the Second World War with the Bretton Woods paper gold standard…

Roaring Twenties – Credit Engineered Boom and Bust

The progression of the Federal Reserve System established in 1913 was similar to the industrial revolution unleashed upon Britain following the Bank of England, with effectively World Reserve Currency status internationally while a domestic credit system industrialized and pillaged the American population nearly from inception… Indeed the two decade period in the US between the world wars has been eulogized and enshrined in Official (and Fake News) History as the Roaring Twenties and the Great Depression of the Thirties and this was all down to the Federal Reserve and the credit and interest rate manipulation of this decivilizing creature of Jekyll Island…

The Twenties And Thirties Predicted In 1912 By Alfred Owen Crozier

The Roaring Twenties was in fact the massive extension of credit (credit inflation) to the domestic American population during the Twenties that fueled industrialism, consumption and the rise of material and moral debasement and degeneracy that inherently follows the debasement and degeneracy of money and credit… The lowering of interest rates that came as a by-product of the extension of credit for the first time reduced the cost of debt and “allowed” the general public in a meaningful way to borrow money from the banks in the form of consumer credit to be invested in all sort of wasteful and capital mis-allocations including buying stocks and the pumping up of the Dow Jones Industrial Average… As teachers, barbers, secretaries and anyone else who fell under the temptation of borrowing credit created out of thin air speculated on the rigged financialization of the Wall Street casinos and future prosperity, stocks soared during the Twenties as bankers licked their chops in preparation for the inevitable credit bust that follows every credit boom, and eyeing the collateral of the poor saps who got fooled into chasing bucks with easy money… The reversal of the decade long inflationary credit boom of the Twenties would be the devastating decade long deflationary bust of the Thirties, and the great dispossessing of the American Dream…

Many more great cartoons encapsulating and giving great and unique insights into the speculative “spirit” and the “madness of crowds” in of the 1920’s, here.

The Great Depression – Socialism In America

The good times of the Twenties gave way to the terrible times of the Thirties, as the credit extension and lower interest rates (debasement) of the Twenties pumped up asset values in terms of land property and business stocks, so was the Thirties the credit contraction, increasing interest rates (and debt service costs) and the pricking of land property and and stock bubbles, triggering many bank runs as savers fled to redeem their gold and silver from banks who over extended paper currency issue… But by the same token those who had borrowed from the banks and whose collateral (land and property) values had also cratered left them unable to service their debts had to default on their assets to be hoovered up by the banks, in farms, factories and other family jewels fraudulently stolen by the racket of Central Banking, and one more painful illustration of the centralization of credit leading to the centralization of property ownership and soaring inequality… History here could have followed the post World War I short term Depression of 1920/21 but this was a different America and with Progressive Saint Franklin Delano Roosevelt taking power after the ridiculing of Hoover’s Tenure, central planning and full blown socialism would seep into and infect the Land of The Free…

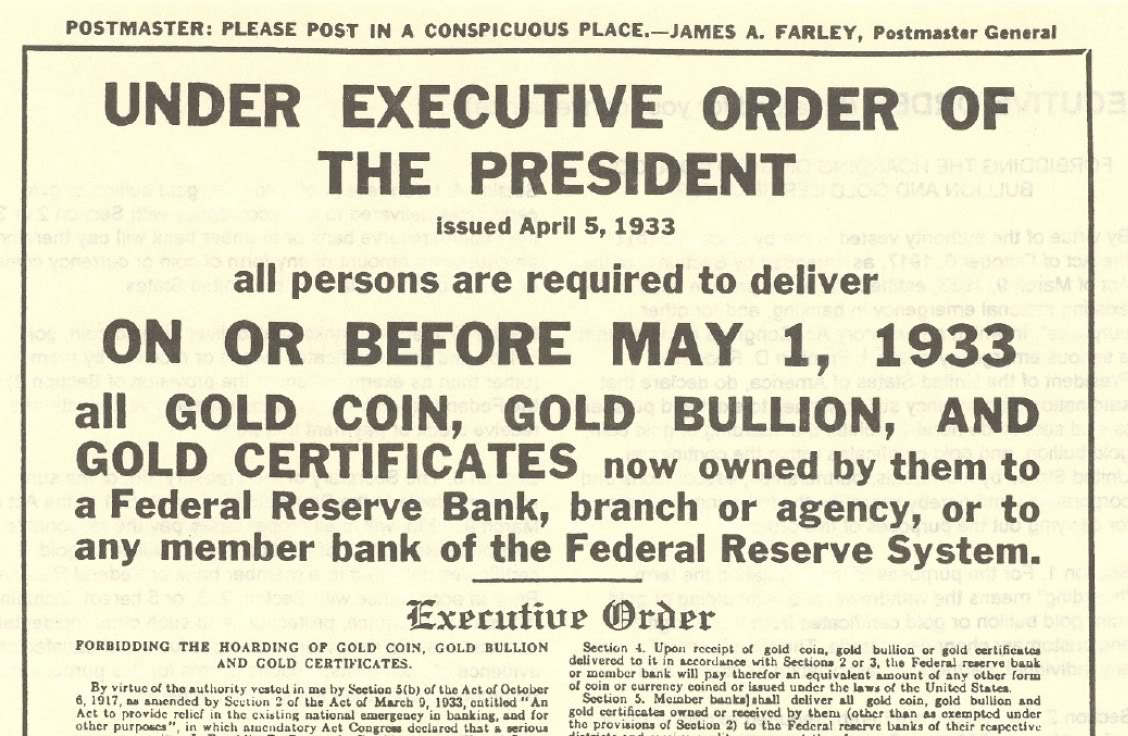

As I discussed in my previous post and apart from the asset dispossession of debtors by bankers during the Depression, was the Emergency Bank Act of 1933 and Executive Order 6102 that made gold illegal to hoard or used in exchange by the American Public, and to remove honest money from domestic circulation substituted with the fraudulent Federal Reserve Note that I would pinpoint as the defining moment of Socialism in America… With gold out of circulation the “authorities” then preceded to devalue the FRN from $20.67 per gold ounce to $35.00, a forty percent overnight devaluation of America’s savers’ purchasing power, and with freely printed and rigged paper banknotes now de facto legal tender, the Fed was able to print into existence the New Deal and Big Government works that exacerbated and prolonged the Great Depression until the end of World War II… Blame the Fed and Saint Franklin for America’s lost decade…

World War II and Bretton Woods

After the utter destruction of Europe for the second time in thirty years and the defeat of Nationalism and Fascism by International Capitalism and Communism (both centrally financed and planned wings of the same bird) and America’s de facto hegemony as military and industrial power house, it claimed sovereignty over the World’s Reserve Currency after the Bretton Woods Deal of 1944 (taking over from Sterling) and the most tenuous and bastardized reserve currency status of history, with near enough all the world’s domestic economies run on paper money but with international trade settlement in the gold reserves of the US Treasury redeemable for paper Pounds, paper Francs, paper Marks, etc etc… With the Dollar still somehow miraculously pegged to gold at the post 1933 ratio of $35 per ounce, post war America printed the dollars to rebuild what it had destroyed in Europe and there was at least some stability for the next generation known to history as the Post World War II Boom of the Fifties and Sixties, however as the Sixties wore on and America’s role as World Policeman in the persistent “fight” against Communism over the world, credit was again extended to facilitate foreign warfare spending especially in Vietnam (Guns) and the domestic welfare spending of Lyndon Baines Johnson (Butter), even the rigging of the London Gold Pool in maintaining the tenuous post War gold peg couldn’t ease the fears of America’s allies that the US was engaged in a massive credit ponzi scheme (which it obviously was), and it was De Gaulle of France that finally triggered the run on the “gold” dollar by withdrawing from the gold pool and sending his French Warships to get the gold for their dollars, setting a run on the US Treasury and fatefully forced Richard Nixon to “shock the world” by closing the gold window thus ending convertability into gold and unleashing the pure fiat standard upon the world…

Post 1971 – Clown World On Acid

Post 1971 – Decimating labour and small business, subsidizing machines and corporations – Life off the Gold Standard

This cutting of any link to scarcity and honesty has led to the last two generations of unhinged, insane and unlimited credit creation that has led to unhinged, insane and unlimited worldwide welfare and warfare ponzi schemes and the unlimited debasement of the world’s producing (taxpaying) populations and consuming (taxeating) populations… The link to gold and scarcity was also a leash upon banking and money printing and therefore a leash on purchasing power of money, family formation and affordable real estate prices, a leash on industrialism and the value of labour in the economy, and most critically a leash on how fast the banksters could print the currency to buy up all the property and inequality, a leash on big government wealth distribution from the private to the public sector, a leash on the protection of private property rights, and the leash on warfare and welfare totalitarian and surveillance states, all of which have been eroded, desecrated, decimated since 1971… Today we live in an essentially worldwide communist gulag, created by bankers to enrich bankers and enforced by big government goons and useful idiots domestically, and enforced internationally by the US Military and Alphabet Agencies (principally the CIA) in executing regime change of any leaders attempting to end Petrodollar hegemony or going back to the Gold Standard, and the costs for printing these totalitarian shitholes into existence has been borne by the private and productive sector and the debasement of the individual, the traditional family structure and local communities worldwide… We truly live in the twilight zone and clown world, and barely anyone alive notices this because of the informational, educational and media mind kontrol matrix that the bankers and their intellectual lackeys and presstitutes have foist upon us from birth…

In terms of credit and business cycles post 1971 obviously the removal of gold as the monetary base of the US as World Reserve Currency has unleashed bigger and more destructive business and credit cycles as central banks (post Volcker) have rigged interest rates ever lower for longer to “remedy” the last credit contraction and recession that they created, and thus creating the next more destructive recession, mass bankruptcy and mass unemployment crisis, and bigger bailouts and centrally planned control levers by our insane elite overlords… The consistent lowering of interest rates over the credit cycle makes borrowing and debt cheaper both domestically for the debt based consumer economy and internationally in various Forex carry trades against other world currencies which suck investors and speculators in as asset values soar as credit eases, but it is at the turn of the credit cycle and when central banks hike interest rates is when consumers and carry trades subject to higher debt funding costs and falling asset prices start losing money and wealth which triggers the defaults and bankruptcies that creates the next credit crisis, as we are currently seeing with the Federal Reserve hiking Federal Funds Rates at the short end while reducing longer term debt or Quantitative Tightening, the opposite of QE, so tightening liquidity and Eurodollar shortages are both increasing rates on auto loans and mortgages in the US and on international carry trades worth TRILLIONS that start unwinding with Emerging Markets (Argentina, Brazilian and Turkey devaluations currently making headlines) first bearing the brunt as the US Dollar sucks liquidity from the periphery first and the liquidity crisis works its way inside toward the core… It is becoming increasingly clear to me at least that the increasing interest rates as marginal as they are in the context of history, in a world so overloaded with indebtedness and poverty as today means that the next credit crunch and financial crisis is a matter of months or quarters away as the Federal Reserve will (as every other crisis) increase interest rates until they trigger the crisis itself, before lowering interest rates and Quantitative Easing to goose the next credit and business cycle...

Post 2008 World – A Personal Anecdote

I was in two minds whether to include this section but I think it gives further context to the discussion so far and will highlight the struggle between capital (machines) and labour that is inherent under an inflationary and fraudulent monetary order…

At the fag end of 2007 I left a professional Quantity Surveying outfit to return back to my roots working as a private Quantity Surveyor for a local building contractor, to essentially run the measuring and estimating division of the business as well as cost monitoring and the production of final accounts for projects from inception to completion… The business had roughly 35 employees and for the first year we were drowning in work as the company turnover and profit levels boomed in what looking back was the blow off top end stages of the Post Millennium Boom, but within a year was the credit crunch and financial collapse of late 2008 and into 2009, and when turnover and profits dried up and private work dried to a trickle as higher interest rates and fear of armageddon crippled banks and borrowers alike… The abundance of work that bred complacence the prior few years was replaced with a dearth of new work and tenders, with only sparse and austere local authority (government) spending not nearly offsetting the collapse in private construction work, the increasing competition between bloated and fattened building firms drove prices and values of construction work lower resulting in lower turnovers and profits for those of us still operating, indeed many with overdrafts and debts went belly up in 2009 and 2010 reducing somewhat the competition but not enough for all the remaining pool of firms to remain profitable, and so the early years of the crisis were the years of eroding savings, increasing overdrafts and the chronic need to shrink the size of the firm in accordance with the new and austere landscape the central banks had engineered…

With only a third to half our previous turnover but the same number of the labour force it became increasingly clear that we had no choice for the long time survival of the business to reduce the labour force by layoffs as our competition was also engaging in, while simultaneously increasing production through purchasing capital and machines to replace the labour being terminated… As we were a long established business and most of our workforce had been with us over a decade (and some two and three decades) coupled with the bureaucracy and legislative morass of employment regulations and redundancy costs of thousands of pounds per employee, it became increasingly clear that offloading and terminating labour was our only choice to remain in business beyond the next couple of years… Throughout 2010-2012 the business lost money in attempting to reduce the labour bill by first voluntary then compulsory redundancies that caused many sleepless nights and despair for our workforce as we all faced uncertain futures, with our labour force dropping from 35 to 15 in around two years… The purchasing of machines such as a telehandler which could do the work of five labourers for a fraction of the cost (after the up front costs) meant that this was our only sustainable option and further highlights one of the key insights of this post, which is in an inflationary world that capital and machines take supremacy over labour and humans in a world constantly getting poorer and forcing productivity improvements to survive… The remaining workforce which we kept on during these very lean years were also industrialized to keep pace with the productivity advances of our competitors who were in exactly the same position, traditional hand tools such as hammers and saws being replaced with electrical power tools such as power saws and nail guns, a practice which certainly increased productivity but also deprived a new generation of apprentices and labour from learning their craft with hand tools rather than power tools and increasing their future dependence on electricity and machines rather than their own labour skills…

After implementing all of these forced changes to the business from 2010-2013 we were able to survive and out-survive the competition many of whom went bankrupt or quit, we were able to reduce the wage bill (outside of the colossal financial hit of redundancies and one off payouts) while investing more in capital that allowed us to stabilize the business, pay off debts and become somewhat profitable although at a far lower level post 2008 than before… Work was sparse and intermittent until the last two years and the Brexit Vote of 2016, from when since work has boomed and credit has again become easy… Today the business is extremely busy as labour shortages are again taking grip (like they did before the last crisis) although paradoxically labour and wages are near the levels they were still a decade ago for many crafts and trades… The last year especially has been a reminder for me of the late boom stages of the last credit cycle a decade ago, and so I expect in the next 12-24 months another credit crunch and financial crisis to dwarf the one we spent the last decade digging ourselves out of… We will be better prepared for the next crisis with half the labour force of a decade ago supplemented by sub-contract (off the cards) labour and with far more invested in capital and machines, however I would expect that the next crisis will force further cutbacks in labour and increased investments in more machines and mechanization of construction practices, as I’ve spent this post describing, is the only option left for small businesses held hostage by inflation and regulation, especially labour regulations… I can’t believe the last decade was fun for much of anyone in any traditional sector or industry of the modern, financialized economy, it certainly wasn’t for me…

Centralization And Decentralization – The Eternal Struggle

The eternal struggle of history is between centralization and decentralization specifically over the money and credit that facilitates human exchange and civilization, and as I have demonstrated there are cycles or periods of both… The History of civilization is the history of money and credit, civilization rising on sound money and credit and falling on debased money and credit, and the last two thousand years have been broadly four supercycles of five centuries… The first five centuries of Rome who rose on the back of the Silver Denarius (and Thier’s Law) and fell on the back of the Antoninianus (and Gresham’s Law), then a millennial supercycle of the early and high Middle Ages and the political decentralization maintained by a combination of precious metals and the ingenious split tally ledger system of fraud proof peer to peer credit and debit that has to be the most REACTIONARY and anarchist technology invented in human history and which allowed the freest markets in human history to operate on a blood, soil and labour based economy throughout Europe, and this last five century cycle of centralization, the REVOLUTIONARY invention of the Double-Entry Book-keeping Ledger and modern banking, the fraudulent accountancy rackets whose middlemen financed wars, The Reformation, Absolutist Monarchies and Nation States, Revolutions, Democracy, Central Banking, Industrial Capitalism, Industrial War, Industrial Welfare and Totalitarian Surveillance… And now in the Early Twenty First Century the trend has flipped again toward decentralization and a new “dark age”, which was spawned by military intelligence and the Warfare Complex and over which it has since lost all monopoly and control, the internet…

Technology – Who Controls The Money, Controls Innovation

Technology, like engineering and machines I want to make clear (in case you get the feeling I’m anti-technology or anti-machines) are neutral vehicles, they do not discriminate in themselves and can be leveraged as good or evil as with everything else, the direction of technology is driven by money, honest or debased… The last five centuries of the West has been the centralization of money and credit, it should therefore come as no surprise that the most important technological inventions have been REVOLUTIONS and the industrialization and mass printing of the “truth”, for infowars and mind control are nothing new, mind manipulation and population control are as old as time because control over the information disseminated in public and consumed in private is the control of the most valuable thing, humans and their minds… As the information following the collapse of Rome was distributed and decentralized amongst the thousands and tens of thousands of monasteries and in the hands of the monks who maintained the intellectual heritage of Europe, in the wake of the Reformation (and sacking of the monasteries) was transplanted by mass production and dissemination of revelation or propaganda (depending upon your own dogma), and the means of production of information became centralized, and has only become more developed and sophisticated over the centuries, from the Fifteenth Century Printing Press (Gutenberg), Nineteenth Century Telegraph, and Twentieth Century Radio, Television and Internet… All these technological inventions were a revolutionary top down control of the means of information production and were leveraged toward controlling knowledge and dividing opinion, as dividing is the only real way of conquering…

The Internet: A Glitch In The Matrix – Decentralization Emerges

It might sound ironic or even oxymoronic that the decentralization trend emerged out of the Military Industrial Complex but technology I repeat is only a vehicle and the so-called privatizing of the internet from the early 1990’s was in effect the corporatizating and capitalizing of a shared public resource and digital commons, a way for people who owned computers and had electricity and internet access to connect peer to peer over the world and share information, by-passing middlemen and gate keepers, and when you think of it highly reactionary, in fact there is nothing more reactionary than the complete decentralization of informational control from the bottom up, even if it was then just a glint in the eye… The early internet was expensive, unreliable and practically useless as this system had to build applications and user cases from scratch, which developed in layers that produced browsers, search engines, websites (broadcasting content), e-mail (peer to peer contact in broadcasting), audio (broadcasting content and peer to peer contact in broadcasting) video (visual broadcasting), indeed a generation later the internet has become so successful that it is now disrupting and consuming the top down and legacy Elite informational mind matrix of television and print, and replacing it with a bottom up social media apparatus although still highly censored and controlled by the Western Intelligence funded first generation startups out of Kalifornia’s silicon valley… With more and more people now on social media venting spleen for or against the madness being unleashed by desperate governments and central bankers drowning in their own fraud, theft and pathological lying, the legacy press, media and television establishments are struggling to maintain their narrative and relevance, and will continue to lose ground against this decentralized bottom up social media war they are now obviously losing…

E-Commerce And Online Revenue Model – Decentralization Flourishes

If peer to peer information sharing and broadcasting was the first application of the post-privatized internet, then the second application of the internet was as a peer to peer platform for exchange of goods, services and labour that developed in the late Nineties and unleashed the Dot Com Bubble, where the low interest rate money printing Federal Reserve headed by “Maestro” Alan Greenspan blew an immense bubble in early internet companies which blew up in 2001 and led to the 2008 financial crisis… However what fraudulent fractional reserve central banking distorted only served to temporarily mask the REAL use case of e-commerce and peer to peer exchange through the internet, and one of the most successful companies in internet history, Amazon, has revolutionalized this concept acting as the middleman between buyers and sellers, as had e-bay and others prior, this is not to mention the explosion in individual websites and businesses having an online store where consumers can buy their products by utilizing financial middlemen such as Paypal and the increasing embrace of commercial and high street banks toward digitalization and online banking…

Indeed if you look at the last generation since the birth of the internet we have all embraced and even become dependent on the internet, for our work and communications (laptop, internet, e-mail, spreadsheets), for our leisure and downtime, and increasingly for our learning and education as the internet is the new, improved and globally accessible for anyone Library of Alexandria… The internet is an incredible resource of public information, wisdom and knowledge if only you know where to look, and admittedly hidden and obscured by the gatekeepers of the mainstream media who do not want you looking and finding truth… The invention of the smartphone in the last ten years has accelerated this global access to information and trade although still highly controlled by legal and banking kerbs perpetuating the extracting cartels and corporate monopolies that enrich themselves by inserting themselves between free trade, direct peer to peer exchange… And this is the reality of the modern and current internet, it must be understood in the context of a corrupt and usurious financial and governmental system where infinite credit creation debases labour and creates poverty and moral debasement and so many online vices that is creating rising concerns on what pornography, dating apps and social media hate, pride and narcissism are doing to younger generations, the most avid (and many say addicted) to the internet and their smart phones…

Distributed Ledger Technology – Decentralization Full Retard

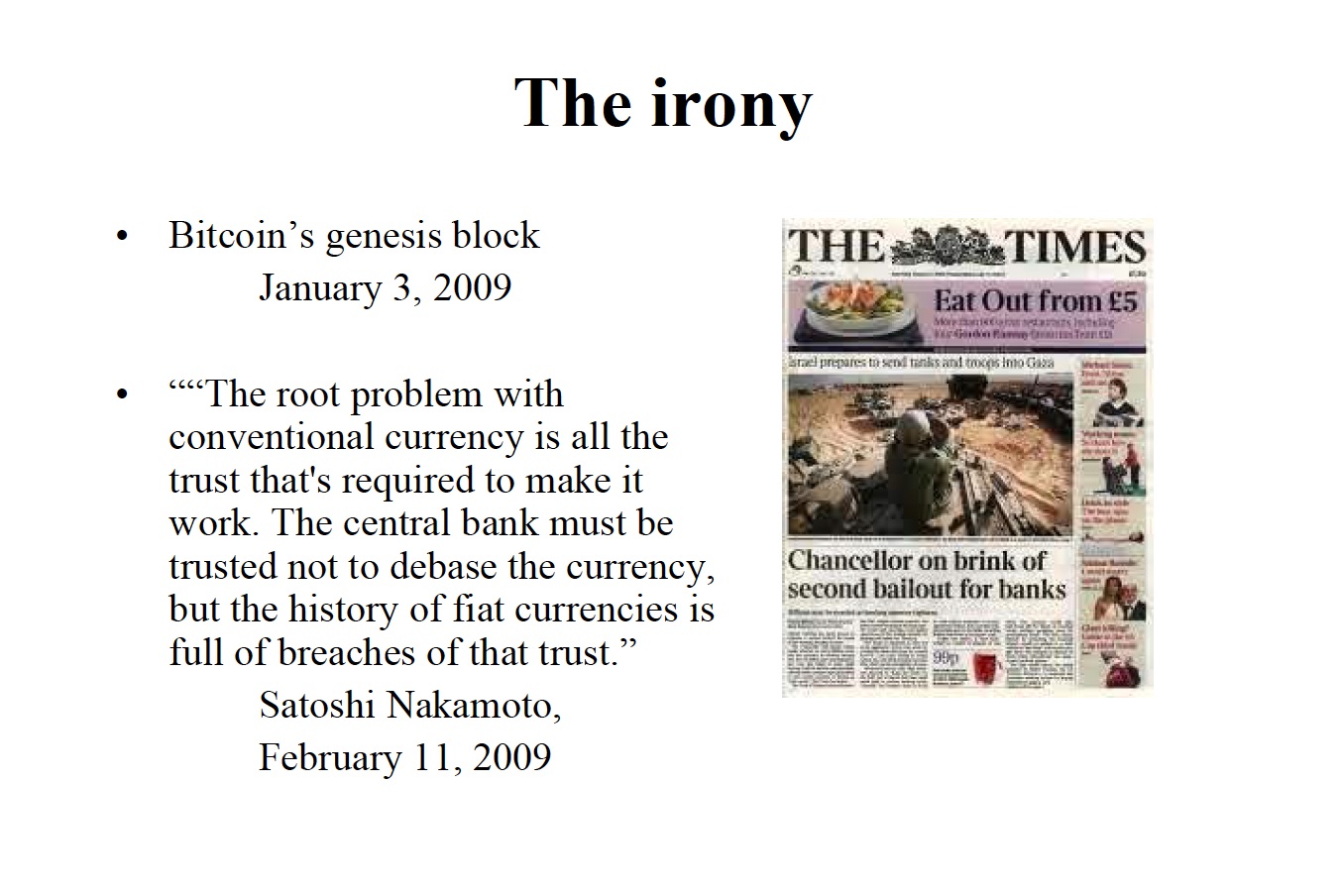

Bitcoin’s Genesis Block Containing The Times Front Page

Bitcoin as the first blockchain was released on 3rd January 2009 at the height of the financial crisis with a reference to the Bankster Bailouts by Britain’s New Labour as the sky was threatening to fall in on the central banking system that did get bailed out while hoovering up on a fresh round of bankrupted debtors after another credit cycle that had just gone bust… The message was made explicit that the dependence on trust in financial and accounting ledgers run by middlemen was blowing up the world, and that it was time for a new monetary experiment and decentralized ledger to operate on the internet and on a worldwide scale… So the first and obvious question is, what is a blockchain?

A Blockchain is simply a database or a ledger system, an accounting mechanism and online method of both storing and moving digital assets that was pioneered by the release of Bitcoin and an inter-connected and ever increasing chain of blocks to confirm digital transactions to be enforced and validated by anyone who can download the software and run an individual bitcoin node, and powered by a Proof of Work algorhythm, the work being the electrical resources and power required to support the network in exchange for a pre-determined reward in the form of a native currency (bitcoins), and began in 2009 with a block reward of 50 bitcoins every ten minutes (3000 per hour) with a currency halvening every 210,000 (x 10 minute) blocks or roughly every four years… In short the maintenance of Bitcoin’s blockchain is split between nodes (users) and miners (currency issuers and security providers) and without a counter-party or middleman and is regulated by consensus between all parties, users, miners, and developers, and is unique on this scale in human history… Bitcoin is the first and still the most successful prodigy of Distributed Ledger Technology and what I would describe as the reinventing of Medieval Europe’s crowning glory, the split tally ledger and the fraud proof marking to market of equity (production) and debt (consumption), but on a digital and infinitely more scaleable plain… Bitcoin’s ledger can exist distributed on as many laptops and smartphones as those who download the software wallets, nodes and apps, and enhances the bilateral split tally into multilateral split tallies between thousands, hundreds of thousands, millions, and eventually billions of parties… The Blockchain as concept and execution on the original reactionary technology of the internet weaponizes this reactionism and why I also call Bitcoin the Counter-Reformation and the return to the Feudal Dark Ages, a financial ledger without banks, an accountancy ledger without accountants, and a legal ledger without lawyers… A simply remarkable technology that will change all our lives in the next decade…

For further reading on Bitcoin and its implications I have written many past posts from different angles and the contexts of: Overview, Gold, Banking, Property and Law, Deflation, Barter and Exchange, Credit and Currency, Technology, The Halvening (Quantitative Tightening), Adoption Demographics, Accountancy, Real Estate and Construction Industry, The Return of Local Banking, The Scaling Debate, Banking Revisited, SegWit Activation, Ethereum, and my last post Gold Revisited… There are a few aspects and contexts I will discuss further here before we get to Labourism and the fall of the machines…

Bitcoin’s Deflation – Baked In The Cake

Bitcoin Moneratism – Quantity In Blue, Inflation Rate In Orange

As powerful and incorruptible as the split tally ledgers of medieval Europe were in providing equality under the law in bilateral legal and financial transactions that also maintained political decentralization in a time before monarchies or banks, the records and ledgers were kept between two parties and so was a local barter ledger that could scale no further, transactions were isolated and unconnected from larger macroeconomic effects such as we would find with gold and silver coins for example, fungibility being where credit ledgers suffered intrinsic disadvantages against money… Where Bitcoin vastly improves upon the bilateral transactions of split tallies is that as a digital protocol it can become a distributed tally ledger, over more than two, split multilaterally over millions or even billions of individual copies of the exact same ledger, and so Bitcoin is both locally scaleable and globally scaleable (and more like money than barter), it maintains as many copies of this global communal ledger as those using the network and updates every ten minutes (10 minute blocks) containing the list of transactions to update the ledger in another ten minutes… The only way Bitcoin can transfer ownership is through the currency so if you hear anybody say that a blockchain does not require a native currency, they don’t understand what a blockchain is, and are not very woke… Indeed the crowning glory of the epic genius of Bitcoin is its currency with a maximum cap of 21,000,000 of which just over 17,000,000 or 80% have already been mined, and with currency halvenings every 4 years (210,000 x 10 minute blocks) it means that deflation for the most part is baked in the cake, as over time liquidity dwindles while adoption increases… As we are only still in the early days Bitcoin’s value at present is highly volatile which is the function of largely unregulated and low friction centralized exchanges exacerbating liquidity and volatility pumps and dumps in this first act of currency speculation, but the second act of Bitcoin is as settlement platform and ledger for peer to peer barter and exchange of goods and services on a local, regional, national, international and intercontinental scale, and act three as the settlement layer for property and private effects (car, home, land, etc) with smart contract layers to register titles to deeds that also decentralizes and destroys the Post Reformation “legal” systems of extraction built up since the advent of Protestant Absolutist Monarchism… All of this production and wealth can be captured only within a maximum of 21,000,000 currency units that redistributes this mind blowing human wealth equally through deflation, increasing purchasing power and increased standards of material living, and no-one skimming off the top… So if you are trying to get your head around why someone would ever be stupid enough to invest in Bitcoin, what you are investing in is trying to purchase your share of goods, services and property in the future by buying an immature volatile and obscure currency in the present, you should not be thinking about the worth of your bitcoins in fiat but in bitcoins, i.e how many of the 21,000,000 distribution do you own because if you own one then you know only a maximum of 20,999,999 people can ever own another one, and considering that Bitcoin exchanges and liquidity is already operating in more than one hundred countries and on four separate continents and with a potential of BILLIONS of people also desiring to invest in a globally scaleable chronically deflationary (just based on demographics) ledger and peer to peer accountancy system, then if you are thinking ten years ahead it is unlikely that you will ever need more than one… After chewing that over, for those who are still fixated on the price of Bitcoin as expressed in dollars, here is the last eight years performance (dated 31st March 2010-2018)…

Deflation – Bitcoin benchmark to date of 31st March 2010-2018 (H/T @czbinance)

Bitcoins Vs Shitcoins – Anarchy Vs Monarchy

The Answer Everytime: No

The claim of every shitcoin (or altcoin) since Bitcoin and its “outdated” and “archaic” setup has been that this particular altcoin is the “new” and improved Bitcoin, ironically because of the one thing that Bitcoin has lacked for the last eight years, that is the creative vision and drive of a centralized development team and authoritarian governance structure… Even though Satoshi Nakamoto designed and released the Bitcoin software for mass consumption he only stuck around as long as it took for the Central Intelligence Agency to start sniffing around, Satoshi disappeared virtually without trace sometime in 2010/11 and despite a near psychotic pursuit of the mainstream and alternative media in “exposing” and “unmasking” the truth of the mystery man (or woman) behind Bitcoin, all such pursuits have yielded no fruit and Satoshi is still disappeared and mysterious, with Bitcoin development having been fractured and distributed into a peer review process for proposals and improvements, and into competitors, factions, collaborators and individual contributors… This decentralized and often fractious and competitive meritocracy makes Bitcoin highly inflexible and resistant to change because as time goes on and the developers and peer review system grows, consensus becomes ever more difficult and to the uninitiated and ignorant this is naturally the fatal flaw and achilles heel of the Bitcoin project, this anarchic and in my opinion intensely feudalistic and meritocratic governance structure will as “History” demonstrates inevitably be superseded by a far more “progressive” and authoritarian governance structure, another mirror of the pre Reformation (feudal) and post Reformation (enlightenment) mindset… As monarchy replaced feudalism, so in the mind of the product of an “Enlightenment” education it must follow that a more tight knit and unified leadership of a more centrally planned blockchain will soon dethrone Bitcoin… It’s only a matter of time, right?!

Every other altcoin apart from Bitcoin has a highly centralized and top down “creative vision” and have slick marketing campaigns and thanks to the ICO mania working nearly exclusively on top of Ethereum millions of even billions of dollars of funding to perpetuate their self promotion empire as the “smartest” and most “innovative” minds and projects in the crypto space that will make Bitcoin obsolete, and while we are still awaiting for this inevitable reality I will now explain to why every other altcoin will fail to scale anywhere close to where Bitcoin will scale because as History and Thier’s Law makes crystal clear, when one (or possibly two) currencies become desired (and in every instance of history because of honesty, purity and excellence) over all else, the wealth and value of the inferior currencies are sucked dry by the reserve currency… But the biggest drawback of the “alternative” absolutist and monarchical governance structure is exactly what was observed in the history of the divine rights of kings, of increasing authoritarianism, corruption and delusions of grandeur, at the heart of these competing shitcoins is the inherent fragility of top down leadership and rule and the polar opposite of Bitcoin’s anti-fragile and anarcho-feudalist bottom up development fight for direction and destiny… Bitcoin is an intrinsically conservative blockchain and ledger as so many progressive and authoritarian developers and personalities have found out, the nature of its governance has chewed up and spat out many of the brightest minds who claimed “Satoshi’s Vision” and “what is best for Bitcoin”, a great many of whom after being rejected by superior developers within a meritocratic development structure, ego bruised, then proceed in launching the authoritarian rivals to challenge what they perceive as Bitcoin’s fatal flaw, its rejection of their talents… In fact this is the central insight of many if not all of the competitors that have launched in Bitcoin’s wake the last decade and the definition of an “altcoin”, they are all predictable and mostly fraudulent alternatives to Bitcoin’s honesty and originality, and this as I will argue next will be the downfall of many if not entirely all of these shitcoins in the long run, and that is government regulation and crackdown on the crypto space that is inevitable, and in my opinion sooner rather than later…

The Empire Strikes Back – The Coming Crypto Crackdown