A recent meme within Bitcoin Twitter: three green years followed by one red. The patterns they keep repeating!

Introduction

This post will revisit my previous halving posts from 2016 and 2020, beginning with brief overviews of what was written eight and four years ago, and compare with today’s 2024 hindsight, before using what we can glean from the last four years in trying to predict the future and the next four years, using some stock to flow basics and long term macro price charts for any illumination on Halving Cycle 2024-2028.

There will be a detailed discussion on whether this is the last Boom and Bust Cycle or if we are indeed in a new Supercycle of a steep and beautiful deflation, and the case has never been stronger in this cycle, citing evidence from the recent ETF approvals in the US, to crypto laws that have been passed in the EU and UK and bills working through US Congress, recent bank capital regulations by supervisory bodies and revisions by financial accounting standards, to financial and legal tender status in two Countries and increasing Bitcoin adoption at Nation State level in the Global South, Bitcoin mining by Nation States, and more.

A halving is a special event in Bitcoin occuring only every four years, and this is the fourth time around as Bitcoin closes in on sixteen years of existence, its awareness and influence going global and undermining the legacy financial and accounting standards that are buckling under all the unsustainable debts that central banks and nation states have created since the last great financial crisis, and as we head into the next financial crisis of the Twenty First Century. Happy halving!

The Bitcoin Halvening (2016) – Quantitative Tightening and Paving the Road to Mass Adoption

The original halving post was published on July 16th 2016, encapsulating my wild optimism of the time as Bitcoin was surging to the hundreds of dollars following the bear market of 2014 and 2015, and is well the worth the read for a stripped down and primitive explanation of the Bitcoin’s issue halving. To keep things brief, I will include the quote below for some context of how early we were back then:

“2016 is 2012, On Steroids

For some comparison of where we are compared to four years ago, the market cap of Bitcoin in late 2012 was approximately thirteen million ($13,000,000) with a bitcoin trading at $13, today’s market cap is approximately ten billion ($10,000,000,000) and a bitcoin trades at $650, but this is only scratching the surface of the progress Bitcoin has made. In 2012 there were a small handful of fiat to Bitcoin exchanges dominated by fractional reserve ponzi Mt Gox and barely any venture capital and general interest in the nascent space. Fast forward to today and there are tens if not hundreds of fiat to Bitcoin exchanges all over the world, billions in venture capital funding the best and brightest start ups in diverse applications from remittances to banking, merchants to consumers, smart contracting to asset registries. The Blockchain is now the increasing buzzword in the fields of banking, law, accounting, property, science, healthcare, and is captivating and scaring the shit out of the modernist bureaucratic class in equal measures. The last four years in so many ways has been the making of Bitcoin.” – Annrhefn, July 16th 2016.

The Early Days…

The Bitcoin Halving Revisited: 2020, Stock To Flow Modelling, and Price Predictions

2016 was revisited in 2020 with my post published 10th April with bitcoin in the thousands of dollars, and again is worth the read and expands upon the 2016 post, as I will be rehashing and updating 2020 in this post I will again include a brief quote to give some context to where we were within Bitcoin in 2020:

“The scale and development of Bitcoin today compared to July 2016 in nearly every aspect is hard to quantify in words, but easy in monetary terms… When I wrote my original post back in 2016, Bitcoin USD had a market cap of $10,000,000,000 (Billion) and bitcoin was trading at around $650, while today Bitcoin USD has a market cap of $130,000,000,000 and trades at around $7,000, 13 X higher in market cap (stock) and 10 X higher in currency (flow), and which basically underpins my simplistic price predictions for 2024 and the next halving…”

The Bitcoin Halving Redux: 2024

In keeping with the economic measurements above, and to bring things up to date, at the time of writing in early April 2024, Bitcoin is currently trading at around $65,000 and its market cap is $1.3 Trillion, so straight away we can see that Bitcoin is 10X higher in stock and flow than four years ago.

“The Bitcoin price in USD increases by a factor of 10X every four years” – flashback to the 2020 post

The Basics of Bitcoin

To explain as simply as possible, Bitcoin is a peer to peer decentralised asset and currency ledger and at its heart an emerging Accounting Standard, through a continuously growing chain of blocks (block-chain) storing financial transactions and data.

The security and updating of this ledger every ten minute block on average is fueled via electricity, that is provided by Bitcoin miners which are specialised machines for attempting to solve a mathematical puzzle, and for which they are rewarded in newly issued bitcoins every block (also called the block subsidy), along with fees for transactions included in the same block (block subsidy + transaction fees = block reward).

Visualising Bitcoin’s ledger on mempool.space. In block 840,000, the halving block, total fees and the subsidy of 3.125 bitcoin totalled 40.751 btc or over two and a half a million dollars!

In essence, the maintenance and updating of the ledger and the emission of credit are both powered by a decentralised pool of mining power (although concentrated in low cost electricity producing geopolitical areas), which means that there is no single issuer of bitcoin or a single counter-party that controls the Bitcoin network, which makes it practically unique in human history. This network can and will replace the historic centralised credit systems which we know today as banking and central banking, and Distributed Ledger Technology as I have discussed in all my posts is a major step forward for Humanity, which fifteen years later is only starting to grasp all of this.

Bitcoin’s Elemental Trinity – Users, Developers, Miners

An interesting read on the approximations of Bitcoin and crypto users in general. Up to August 2023, there are estimates of 172 million Bitcoin users, and 25 million self custodying their bitcoins (source)

To expand further, Bitcoin can essentially be divided into three categories of participants, in users, developers and miners.

Users – The most popular division are those that invest in Bitcoin as a store of value and payment network by either purchasing or accepting bitcoins or spending and selling bitcoins, for goods and services or national fiat currencies. This is by far the most common group and is a far easier method for the average person to adopt the network via its currency, rather than the more specialised developers or miners. Because of the nature of Bitcoin as a worldwide network operating on some level in all 195 countries of the world simultaneously, the technology is being adopted from the bottom up via the development of Bitcoin to Fiat currency exchanges that grows by the day. While Bitcoin began from scratch with zero users and zero value, it has today reached estimates of 25 million self custodial users, within a burgeoning ecosystem of 200 million users that have bought bitcoins on an exchange, and approximately 400 million crypto-currency users worldwide.

Developers – Having spent the first eighteen months nurturing Bitcoin through developing and mining, from Summer 2010 Satoshi Nakamoto’s contribution diminishes at exactly the time there was more demand on him to captain the inexperienced ship, by the end of 2010 he had disappeared completely leaving the project in the hands of a handful of early disciples. By disappearing Satoshi essentially left the future to competing developers to fight it out for future direction, that has created Bitcoin’s bottom up and anarchic leaderless developer structure, there have been numerous Wars the most famous being the Blocksize Wars between 2015 and 2017, pitting big blockers and network centralisers against small blockers and network decentralisers. It was a ragtag band of small blockers that won the scaling War against big blockers, and since 2017 developers have surged from the hundreds into the thousands, which also means that the fighting and competing over Bitcoin development grows over time, making Bitcoin ever more resistant to change as should be expected, as its value grows over a Trillion Dollars. Even so, there have been numerous improvements that have achieved consensus, such as SegWit in 2017 and Taproot in 2021, and it likely the future will see further consensus on improvements, to scale the network to more self custodial users.

Powerful and specialist computers consuming electricity to mine bitcoin (source)

Miners – Completing the trinity are the miners, who manufacture and deploy specialised machines and electricity to protect the Bitcoin network from attacks, and in return get rewarded in currency, bitcoin. In the beginning it was possible to mine on personal computers and laptops, and this is how Satoshi mined the first million coins (fifteeen years later have still not moved). As interest in and the value of Bitcoin increased, competition in mining led to increasingly dense use of electricity, and a shift in processing power from CPU (Central Processing Unit) to GPU (Graphics Processing Unit), and by 2012 had advanced to ASIC (Application Specific Integrated Circuit). Since the Age of the ASIC electrical costs have become increasingly important to mining Bitcoin, reflected in the centralisation of mining in low cost electricity countries, especially China between 2012 and 2021. In May 2021 the China Communist Party (CCP) officially banned Bitcoin mining within the country, and even though mining remains healthy in the shadows and dark energy markets within China, global hashrate has migrated and decentralised to the rest of the world, especially to the West in the last three years, which strengthens and distributes the mining community geographically.

The miners are an essential element of the Bitcoin network, which they have leveraged to try and gain supremacy over users and developers, indeed the big blockers in the BlockSize Wars of 2015-2017 were the miners in order to increase their fees from transactions, the users and developers had to assert their supremacy over the miners and force them to bow down, and in the process recognise the supremacy of users (and full node runners) over the network.

The most successful distributed consensus network we have ever seen, works like this! (source)

The Fourth Element – Bitcoin Exchanges

Bitcoin at its essence is a peer to peer ledger and network, but our present reality is trapped within a fiat currency world. The most convenient way of entering Bitcoin currently therefore, is through an Exchange for national fiat currencies (source)

Exchanges could be considered a sub-set of the users but they are also unique by financialising the Bitcoin network, by connecting to the banking system that currently imprisons the world’s debts wealth. Because Satoshi created Bitcoin with the miners as sole issuers of currency and first receivers, in the early days there was as such no exchange built to allow anyone other than a miner to own bitcoins. The first major exchange of note in those early years was Mt Gox in Japan and launched in July 2010, that allowed both miners to sell their bitcoins for fiat and for outside retail investors to sell their fiat to own bitcoins, and therefore it became the premier price discovery point of Bitcoin’s early value in fiat currencies. Other notable early exchanges were Bitstamp launched in November 2011, LocalBitcoins in June 2012, Coinbase in October 2012, and Bitfinex launched December 2012, but Mt Gox dwarfed them all as the most liquid exchange with an estimated 70% of global network share heading into its cataclysmic bankruptcy in February 2014, and its aftermath was the worry that the death of Gox would also kill Bitcoin.

In the wake of Mt Gox, Bitcoin exchange has decentralised to all of the world’s two hundred countries, and developing in different ways and means depending on national governmental regulations and banking restrictions, that will contribute to financialising and the success of Bitcoin in the long term, while in the short and medium term Bitcoin will be threatened by governments and banks that will attempt to control and co-opt, via the banking system and their leverage upon Bitcoin Exchanges.

Bitcoin Monetary Policy and Issue Schedule

Chart of Bitcoin’s issue schedule, quantity (stock) in blue, and inflation rate (flow) in orange (source)

Bitcoin’s issue schedule has been pre-programmed with a maximum cap of Twenty One Million (21,000,000) units, that began on the 3rd of January 2009 issuing 50 bitcoins every ten minute block up to 28th November 2012, 210,000 blocks were mined, issuing 10,500,000 bitcoins (210,000 x 50), or half the maximum cap.

On the 28th November 2012, the block subsidy halved to 25 bitcoins every ten minute block (3600 per day) lasting until the 10th of July 2016, mining 5,250,000 bitcoins (210,000 x 25), for a cumulative total of 15,750,000 and/or 75% of total issue in the first eight years.

The issue once again halved following July 2016 down to 12.5 bitcoin every ten minutes (1800 per day) with the third halvening epoch lasting until the 11th of May 2020, to create another 2,625,000 bitcoin (210,000 x 12.5), for a cumulative total of 18,375,000 and/or 87.5% of the maximum…

The fourth halving epoch that dropped the subsidy to 6.25 bitcoin every ten minutes (900 per day) will end around the 19th of April 2024, when another 1,312,500 bitcoin (210,000 x 6.25) will have been mined for a cumulative total of 19,687,500 and 93.75% of maximum issue…

The fifth halving epoch between 2024 and 2028 will mine just over 600,000 at 450 per day for 96.975% of the maximum, with less than a million left to mine for the next over hundred years.

Digital scarcity and deflation are therefore intrinsic properties of the Bitcoin protocol with monetary flows halving every four years, fueling the increasing the user base that is today estimated at over 100 million people, and reflected in Bitcoin’s price in fiat currencies on exchanges globally.

Bitcoin Ownership Distribution

A very useful graphic for Bitcoin’s ownership distribution up to February 2024 (source)

Bitcoin and Deflation – Measuring in Fiat Currencies

To demonstrate the deflationary properties of Bitcoin in fiat currencies I include the table below of Bitcoin’s price on the 3rd of January (and Bitcoin’s birthday) in US Dollars, every year since 2009, and which I’ve taken from this chart…

| Date and Year | Bitcoin Price in Dollars | Green/Red Dot |

| 3rd January 2009 | $ 0.00 | N/A |

| 3rd January 2010 | $ 0.00 | N/A |

| 3rd January 2011 | $ 0.30 | N/A |

| 3rd January 2012 | $ 5.22 | 🟢 |

| 3rd January 2013 | $ 13.50 | 🟢 |

| 3rd January 2014 | $ 802.85 | 🟢 |

| 3rd January 2015 | $ 314.85 | 🔴 |

| 3rd January 2016 | $ 433.58 | 🟢 |

| 3rd January 2017 | $ 1,021.60 | 🟢 |

| 3rd January 2018 | $ 14,978.20 | 🟢 |

| 3rd January 2019 | $ 3,931.05 | 🔴 |

| 3rd January 2020 | $ 7,345.38 | 🟢 |

| 3rd January 2021 | $ 32,129.41 | 🟢 |

| 3rd January 2022 | $ 46,458.85 | 🟢 |

| 3rd January 2023 | $ 16,680.20 | 🔴 |

| 3rd January 2024 | $ 42,855.81 | 🟢 |

Three green years and one red year have repeated the last three halving cycles. If the historical pattern repeats, 2024 and 2025 will also be 🟢

The above table provides a brief snapshot to Bitcoin’s value on one particular day in every year since inception to demonstrate its deflationary and currency appreciating powers over the fifteen years, however does not tell us much on how the halvening effects upon what I would call the Bitcoin boom and bust cycle.

Bitcoin’s Yearly Candles Chart captures the boom and bust cycle well – 🟢🟢🟢🔴 (source)

Bitcoin Intra-Cycle Volatility – Boom and Bust Cycles

Following historical patterns Bitcoin should have taken out all time highs in Quarter 4 of 2024, however it has already broken all time highs this cycle in Q1, probably due to the ETF Approvals that are a big deal! (source)

To try and explain the above chart, the block subsidy halving halves the inflation and flow rate that are created remember, by the miners. The halving effectively doubles the cost of production to mine bitcoin overnight, that will force the more uneconomical and unprofitable to turn off their machines and disconnect from the network for the time being. The halvening is also a Supply Shock increasing the scarcity of supply compared to its demand from the four corners of Earth, the only way to balance supply and demand is via prices, and a rising Bitcoin price.

Three days after halving, the production cost of a bitcoin is estimated at $102,000, $35,000 above Bitcoin’s market price! (source)

While the supply shock may not show up in the price of Bitcoin on the day of the halving, history has demonstrated that the price has started shooting up in the six months following the halving, passing the all time high around the end of that year. The year following the halving is the parabolic bull market, when it is being talked about by everyone believing the moon will be reached, before imploding by 80% in the year after, shaking out all the corrupt exchanges and institutions, paper hands investors and gamblers, and re-setting supply and demand for the next four year cycle.

Unlike the fiat banking system there are no bailouts in Bitcoin, the boom and bust cycle weeds out leverage and corruption, and we start the next cycle cleaner and leaner! (source)

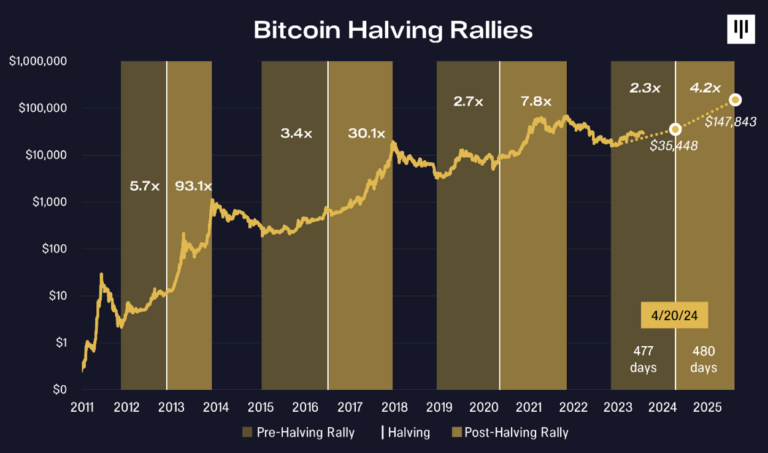

In the 2012-2016 Cycle, Bitcoin halved on the 28th of November 2012 around $10, before mooning to over $1,100 in the cycle high on the 5th December 2013, one year and one month since the halving. Bitcoin then fell 80% over 2014 to hit its cycle low around $200 on the 17th January 2015.

In the 2016-2020 cycle Bitcoin halved on the 10th July 2016 at $650, before zooming to the cycle high of $20,000 on the 17th December 2017, one year and five months since halving. Bitcoin then again imploded another 80% to the cycle low of under $3,500 on the 15th of January 2019.

In the 2020-2024 cycle Bitcoin halved on the 11th of May 2020 around $8,000 before thundering to hit a cycle high of $70,000 on the 10th November 2021, eighteen months since halving. Bitcoin then fell another 80% to a cycle low of $16,000 on the 20th November 2022.

Is S2F broken? (source)

It should be noted here rather astoundingly that Bitcoin’s cycle highs in the last three four year cycles, have hit in December 2013, December 2017 and November 2021, four years apart in the last twelve years, and in the eighteen months following the halving. It should also be noted that Bitcoin’s cycle lows hit in January 2015, January 2019, and November 2022, one year following the cycle high, and eighteen months before the next halvening.

If the historical pattern strikes for a fourth time, the halving in April 2024 will likely lead to the cycle high at year end 2025, just over eighteen months from today.

One speculative chart on Bitcoin Halving Rallies, predicting $ 148,000 at Year End 2025 (source)

Revisiting My 2020 Price Predictions in 2024 – Mea Culpa!

My 2020 Price Predictions 🫣!

To compare 2024 hindsight with 2020 foresight, the following table will provide a crude scoring matrix.

| Price Prediction | Actual Price | Hit/Miss | Time Prediction | Actual Time | Hit/Miss | |

| Cycle High Price | $ 400,000 | $ 70,000 | Comical Miss! | December 2021 | November 2021 | Hit! |

| Cycle Low Price | $50,000 | $16,000 | Comical Miss! | December 2022 | November 2022 | Hit! |

| Halving 2024 Price | $ 65,000 | $64,000 | Hit! | N/A | N/A | N/A |

To begin in my defence we will look at the positives. Even though my time predictions were not month perfect, predicting the cycle highs and lows to the nearest month, twenty months and thirty two months in advance, I’m claiming as a hit. I may also be lucky to hit the halvening price four years out to within the nearest $ 2,000 as this all time high wasn’t expected until the end of this year, nevertheless I will take any victory I can in this speculative field. So we are pretty much on schedule in 2024 as I predicted on this month in 2020, which leaves us with the cycle high and low prices.

Firstly, there is no real defence to having predicted a $400,000 cycle high when in actuality it barely hit $70,000, and the same for the cycle low of $50,000 when in actuality it hit $16,000, so much egg is on my face and a massive mea culpa on my part for comical and catastrophically optimistic price predictions. I took a highly simplistic extrapolation as I qualified in the 2020 post, and it has aged like a fine milk. But I have noted since that many other Bitcoin analysts felt that there was something off about the 2021 parabolic bull market, and that there was price manipulation that may have suppressed the price to the muted $70,000 cycle high. We will discuss this further in the next section.

2021 Bull Market Analysis

Five year BTC/USD chart – we are interested in year 2021 (source)

2021 was a strange year in terms of the price. It crossed its all time high from the previous cycle at $20,000 around Christmas of 2020, and had surged to $60,000 by the beginning of April. It consolidated until the start of May, but instead of pushing higher momentum was broken and then Bitcoin crashed for a couple of months bottoming just above $30,000. It then found a second wind and soared to the cycle high of $70,000 on the 10th November, and then just completely broke lower and the Bull Market went poof! The previous cycle highs had been early to mid December in 2013 and 2017, and there was a general feeling of being short changed and there had been purposeful manipulation to break the bitcoin advance in May and November, and it felt a more capped and constrained bull market than the prior two bull market years. I have thought a lot about this over the last two years, and so it is time to commit some of my thoughts in public, and get us to why this next bull market year will likely be different in 2025, that will inform further my price predictions for the fifth Halving Epoch 2024-2028.

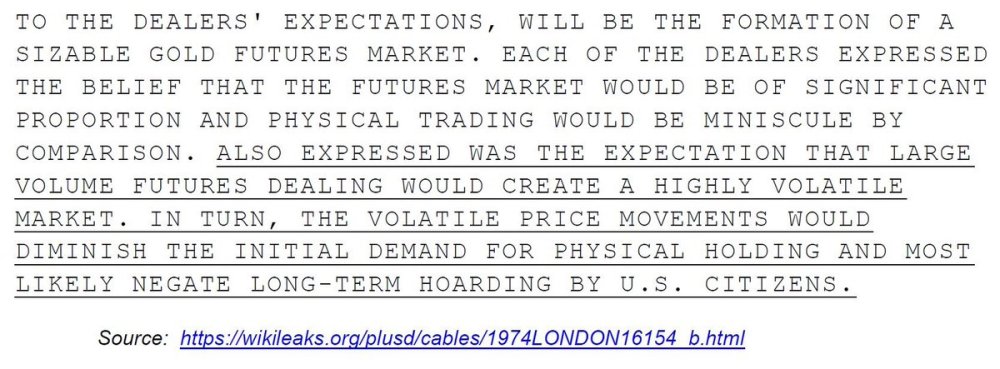

1 – Futures manipulation

An old favourite that has been included in many of my past posts – Wikileaks 1974 Cable Reveals Purpose of Creation of Gold Futures Market (H/T Smaulgld)

“Indeed the launch of cash settled futures late in December 2017 co-incided with the manic driven peak of Bitcoin at the cycle high of around $20,000, the year since the price of Bitcoin has collapsed some 80% and this Correlation Is Causation event has brought out all the schadenfreude of the hard money gold bugs, in proclaiming that the price of Bitcoin is now rigged in exactly the same way as physical gold prices were rigged following the end of the Gold Standard in 1971…” – Annrhefn, Bitcoin Kills Banking Redux: Exchanges, 25th February 2019

In my Bitcoin Kills Banking Redux post in February 2019, I spent a section on Bitcoin Derivative Exchanges, discussing specifically Futures Exchanges and Exchange Traded Funds (ETF), and how they would effect on Bitcoin’s market and price structure, at the cross-section with Traditional Finance and the Wolves of Wall Street. I mocked the goldbugs in their mistaken belief that cash settled futures would muzzle Bitcoin and that the launch of CBOE cash settled futures in December 2017 had little to do with Bitcoin’s price collapse in 2018, the recovery of Bitcoin to a new parabolic Bull market in 2020 and 2021 confirmed that Futures had *limited* influence on Bitcoin’s four year halving cycles. However I do believe that Futures played their part in short term price manipulation, momentum breaks, and capping Bitcoin upside.

The concept of Futures is to allow commodity producers to short their own commodity via financial derivatives, and is an ancient invention. Commodity producers in larger and more established industries have Futures markets such as oil, gold and agriculture, and in the US are regulated by the Commodity Futures Trading Commission. It was the CFTC that declared Bitcoin to be a commodity in 2015 and approved the launch of Chicago Board Options Exchange (CBOE) Futures on the 10th December 2017 (one week before the top), and Chicago Mercantile Exchange (CME) Futures on 17th December 2017 (the day of the top). This was a big step forward in the financialisation of Bitcoin and for miners especially, as it allowed them to sell Bitcoin short in the future to counterbalance that they were long producing the commodity, and stabilised businesses for the long run in producing and distributing bitcoin.

bitcoins first day – @JimBTC’s hilarious take on the chaotic CBOE Futures launch of 10th December 2017! (source)

The drawback of Futures on the other hand, is that it tends to commoditise production and tethers the price above the cost of production, which is the price Bitcoin miners have had to pay for increased hedging and stability they themselves have engaged in. As the Futures are also cash settled it allows for price manipulation, as is well documented in the Gold Futures markets mercilessly rigged by the gold trading desks at the Bank for International Settlements (BIS) and other Central Bank proxies to “manage” the price of gold, bitcoins do not have to be produced to short the price which can be utilised to break Bitcoin’s price momentum, as I believe happened in the 2021 Bull Market.

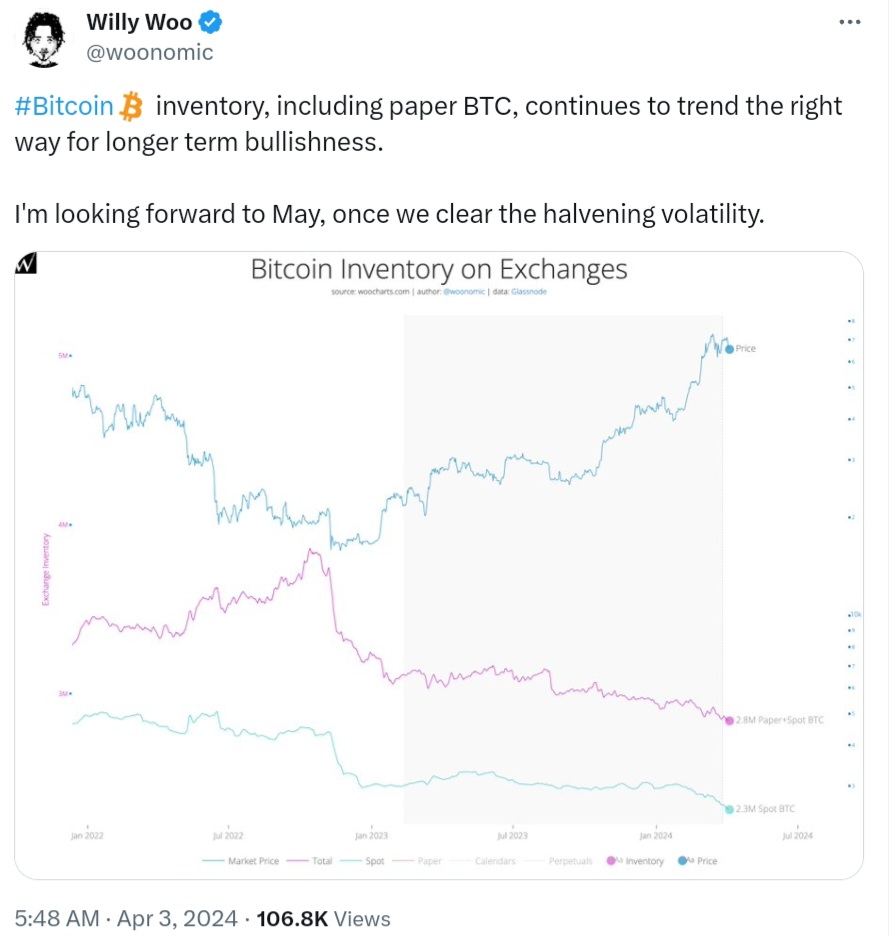

Paper bitcoin (futures) peaked in late 2022, and has been decreasing since. The price has only gone up since then (source)

Another reason I believe that we are passed peak Futures price suppression and manipulation, are the recently approved Spot Bitcoin ETF’s. As my above tweet describes, from December 2017 to January 2024 Wall Street basically had a synthetic way to short the Bitcon price via cash settled futures, but there was no effective scalable method for Wall Street to go long the commodity and what would act as a counterveiling force on the gravity of Futures. What ETF’s approved in the second week of January 2024 have enabled, is for Wall Street to hoard and store Spot Bitcoin, taking bitcoins out of active circulation (over 400,000 bitcoins locked in new ETF’s since Jan + another 300,000 left in GBTC) and neuters the previous powers of cash settled and synthetic Futures over the price of Bitcoin. This likely means that the bull market cycle in 2025 will be different from the 2021 Bull Market of 2021, as Wall Street can now go long the commodity on ETF’s to balance out shorting the price via Futures.

Tweeted one year before ETF Approvals in January 2024 (source)

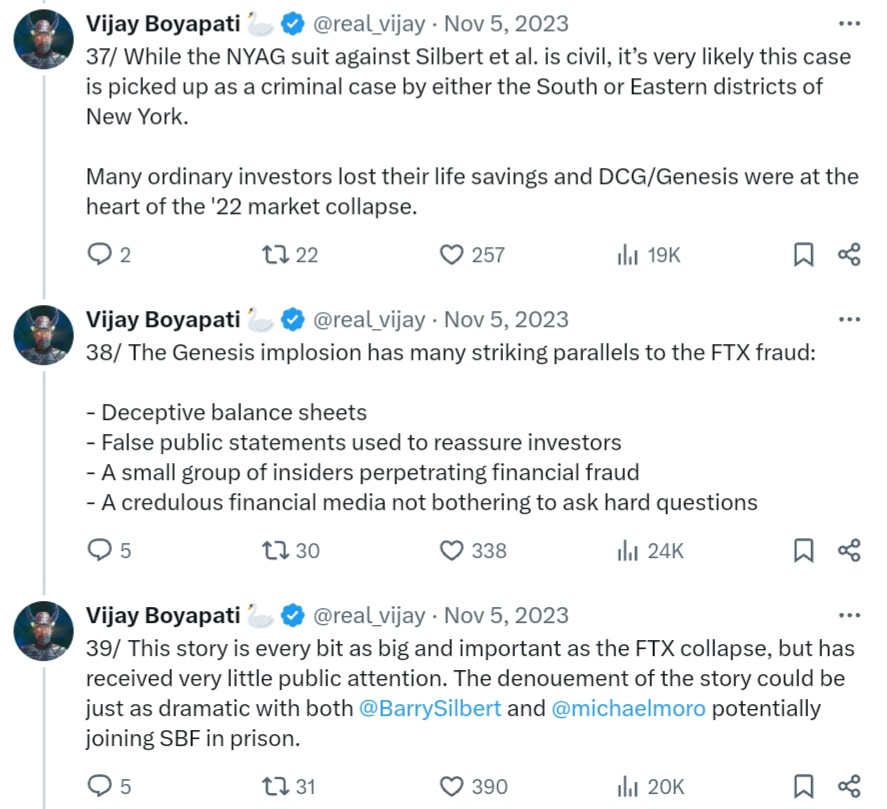

2 – The Collapse of 3 Arrows Capital, Celsius, Block-Fi, Genesis, FTX, and the GBTC Arbitrage Trade

A thorough and excellent thread on the shenanigans going on in Bitcoin’s exchange ecosystem in the Bull Market of 2021 and Bear Market of 2022 (source)

Grayscale Bitcoin Trust (GBTC) was a prototypical Bitcoin ETF that had launched in 2013 and had afforded Wall Street one early avenue into a bastardised and inefficient method of Bitcoin exposure, giving Grayscale and owner Digital Currency Group (DCG) a virtual monopoly on institutional spot ownership of Bitcoin. Because the SEC had also rejected ETF’s and competition since at least 2019, GBTC shares traded at a premium to Bitcoin’s spot price to reflect the dearth of competition, leading to an arbitrage trade, going long GBTC shares while shorting spot Bitcoin.

Some of the scammiest biggest exchanges in the Bitcoin space profited from the GBTC Arb during the Bull Market of 2020 and into 2021, including BlockFi, Three Arrows Capital, Genesis Trading, and Alameda Capital (subsidiary of Sam Bankman-Fried’s FTX).

The unlocking of Bitcoin exposure and competition to GBTC during 2020, including Michael Saylor’s Microstrategy, Futures ETF’s and Foreign Spot ETF’s, would end the Arb Trade, and on February 3rd 2021 the GBTC Premium turned negative. All that were long, were now underwater and losing money.

The collapse of the stablecoin Terra Luna in May 2022 blew up Three Arrows Capital, which in turn blew up BlockFi and Genesis, and created turmoil within the Bitcoin and Crypto exchange space in general.

The bankruptcy of Bankman-Fried’s FTX and Bitcoin price bottom co-incided in November 2022, and in January 2023 Genesis declared bankruptcy.

In conclusion, Bitcoin’s boom and bust cycle in 2020-2024 was heavily influenced by unbacked Bitcoin Futures and by conspiring early Generation Bitcoin exchanges, that is now I believe mostly at an end. The collapse of some of the biggest names in 2022, from Three Arrows Capital, to BlockFi to Alameda/FTX, and Genesis, have flushed out the majority of the corrupt turds clogging Bitcoin’s water pipe over the last several years. With Terra Luna’s Do Kwon facing extradition to South Korea or the US for fraud, Three Arrows Capital Kyle Davies on the run, Sam Bankman-Fried of FTX/Alameda just sentenced to twenty five years in prison, and jail time also likely for DCG/Genesis/Grayscale kingpin Barry Silbert, the last couple of years has seen the clean up of the Bitcoin/crypto space of corruption. At the same time, Bitcoin’s exchange network has upgraded to Wall Street scale and legitimacy, particulary with the approval of Spot Bitcoin ETF’s, unleashing behemoths and stalwarts such as BlackRock and Fidelity into Bitcoin custody, and opening up the possibility of Trillions in new capital in the next bull market, to flow into Bitcoin in the next couple of years.

Bitcoin has grown up a lot in the last four years!

After dominating Bitcoin equity in the TradFi space for a decade, Grayscale Bitcoin Trust has bled over 300,000 bitcoins in three months! The Wolves of Wall Street are tearing it apart! (source)

Bitcoin Price Predictions For Halving Epoch 2024-2028

Having explained how much Bitcoin’s exchange infrastructure has developed and matured in the last four years, I believe will have long term effects on Bitcoin’s Boom and Bust Cycle, increasing liquidity and reducing volatility, thus stabilising the price and making it even more attractive as a store of value for the individual and the institution. Even though I expect more rampant leverage and corruption and a new wave of crypto scams in this cycle, I don’t think we will see the scale of the corruption and collapse of Bitcoin exchanges as we saw in 2022. I’m not sure however that Bitcoin’s Boom and Bust Cycle is over this time around, and so those who over-leveraged in the 2025 Bull Market will be flushed out by Bitcoin’s Bear Market in 2026, alongside fraud, embezzlement and stealing of customer funds. We shall see.

In keeping with Bitcoin’s prior three cycle high peaks in December 2013, December 2017, and November 2021, I will guesstimate the cycle top in December 2025. Having been catastrophically wrong on the cycle high price last time round, I am edging conservatively this time around, taking the difference from December 2017 high of $20,000 to November 2021 high of $70,000 at 3.5X, and extrapolating that to give a December 2025 cycle high of $250,000. I then expect Bitcoin to fall around 80% from peak to trough like the last three times tagging a cycle low of $50,000 in December 2026, and I guesstimate the price at the next Halving in early 2028 to be around $150,000.

tl:dr extrapolating prologue from past for Halvening Cycle No 5 (2024-2028):

Price at 2024 Halving (April 2024) : $64,000

Cycle High Price (December 2025) : $250,000

Cycle Low Price (December 2026) : $50,000

Price at 2028 Halving : $150,000

So these are my preliminary and very approximate price points for Halvening Cycle No 5, and will compare them to other stock to flow models and macro chartists further on.

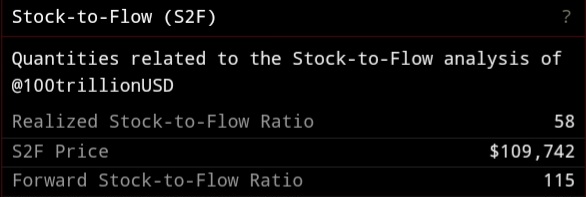

Stock To Flow Updates

I spent a whole section describing Stock to Flow dynamics in the 2020 Halving Post, so I will not repeat it again here. The nature of Bitcoin’s halving cycle effectively means that Bitcoin’s S2F doubles every four years!

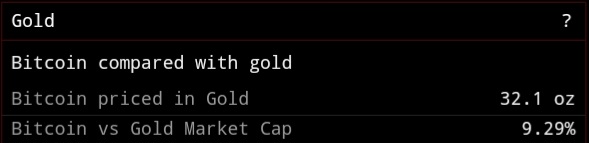

With gold’s stock to flow around 60, Bitcoin will be double that following the 2024 halving, courtesy of Clark Moody’s Bitcoin Dashboard (source)

Plan B Charts – 2024 Updates

I spent a lot of the 2020 Halving Post discussing Plan B’s modelling and charts, which can be read there.

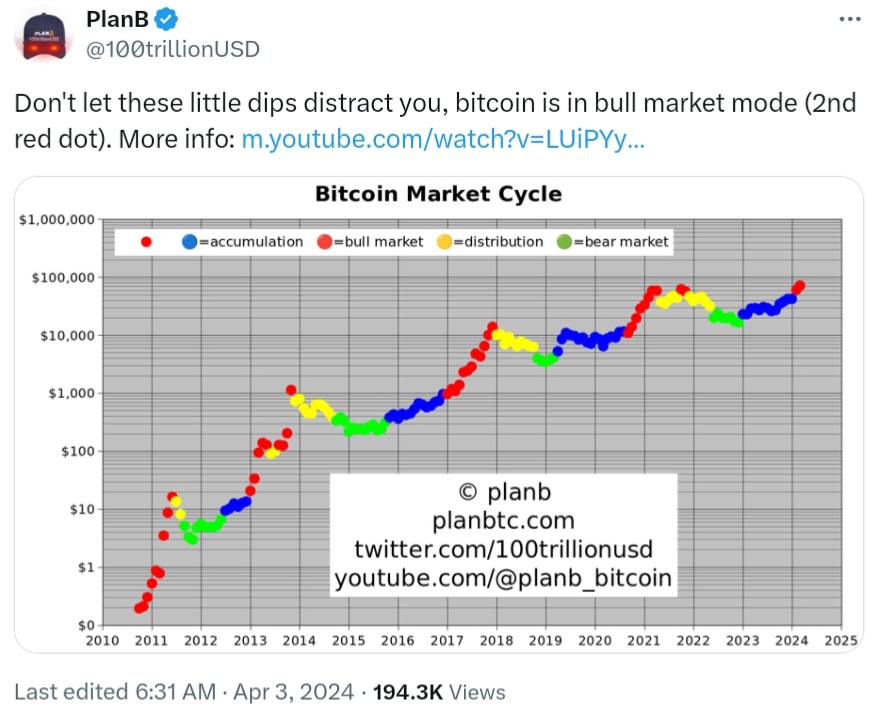

We are in the red dot period again, and Bull Market (source)

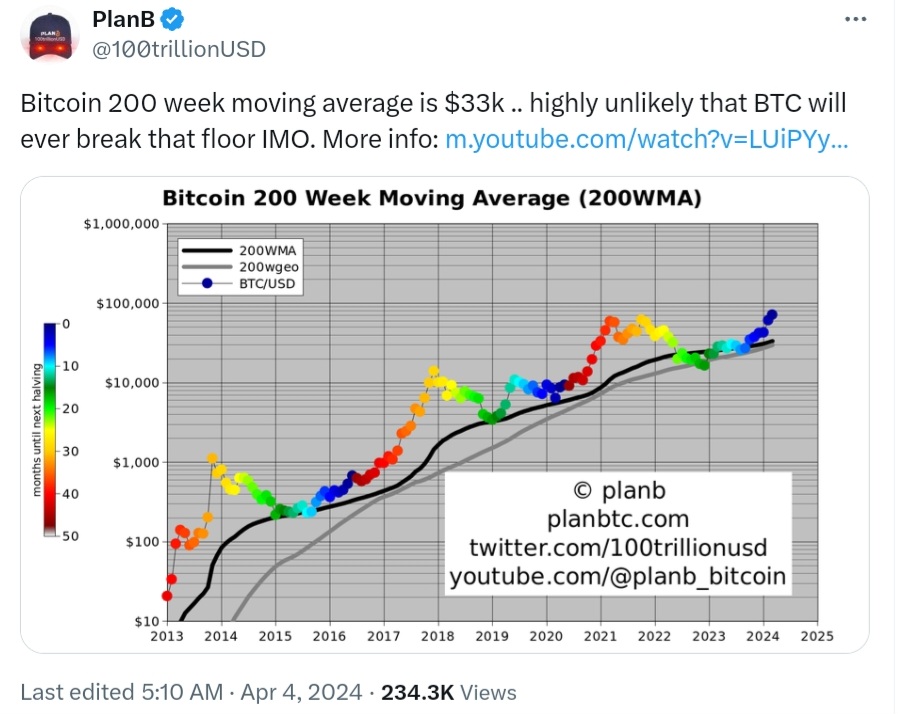

Moving averages were discussed in my 2020 Halving Post, and the 200 week (four year halving cycle) moving average is one of the longest moving signals out there, the current floor is around $33,000 (source)

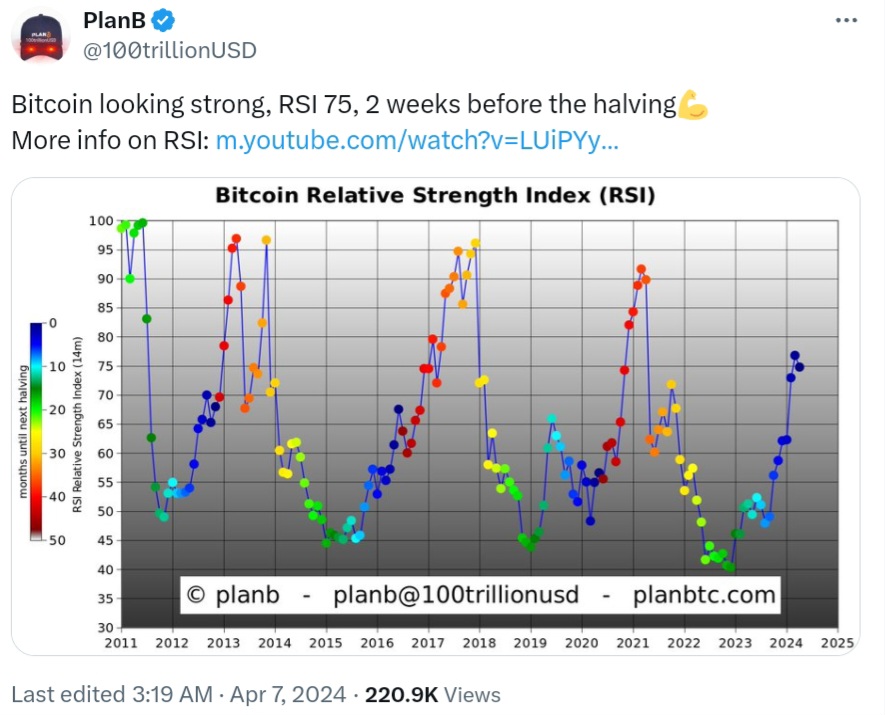

Relative Strength Index (RSI) was another metric I referenced – at a very healthy 75 going into the halving (source)

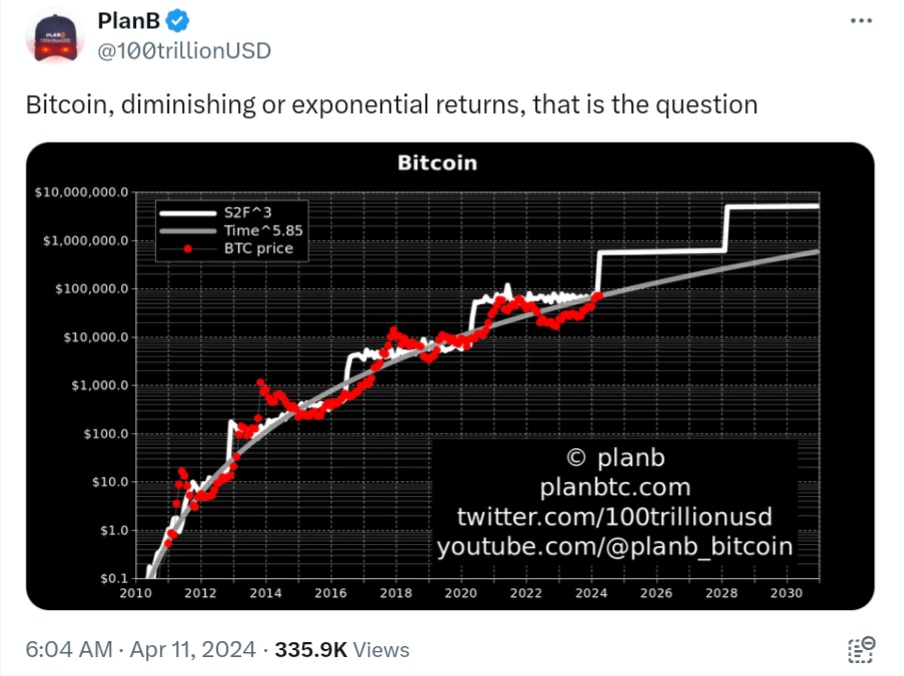

Bitcoin, diminishing or exponential returns, that is the question! (source)

Further Macro Charting

An interesting tweet thread I came across with price targets between $150,000 and $275,000 (source)

Bitcoin Power Law Chart approaching $300,000 top, note 2021 underperformed (source)

2025 Cycle Peak Target of $250 -$300k (source)

Another tweet estimating a $250,000+ cycle high peak (source)

QUESTION: The Bitcoin Supercycle – The End of Boom and Bust?

In the middle year of the three yearly Bitcoin Bull Run 🟢🟢🟢 as its price is moving upwards at a rapid clip, there begins the talk about the Bitcoin’s Supercycle. It happened in the 2017 Bull Run and that repeated from 2020 as Bitcoin influencers and thinkbois contemplated the end of Bitcoin volatility and its four yearly boom and bust cycles, and an ideal world where Bitcoin adoption and price stabilise in a steep and beautiful deflation. Alas, the boom and bust cycle repeated in 2021 and 2022, and a fresh bull market instigated in 2023, and is being catalysed in 2024 by the increasing monetisation of Bitcoin as a store of value by Wall Street’s biggest kingpins and their bitcoin gobbling ETF machines. And so, the question is now being talked about again as we cross another halving and liquidity tightening event, as the UK and CCP controlled Hong Kong have announced ETN‘s and ETF‘s in the coming months, adding another two large global financial centres to the insatiable demand for bitcoins, that is supply constrained and about to drop from 900 to 450 per day!

A reminder of just how much bitcoins the US ETF’s are gobbling up, thousands per day (source)

Although global ETF’s are a major game changer in opening up the global financial system to Bitcoin exposure, on top of the persistent demand from your average pleb who stayed humble and stack sats the last fifteen years, this is just scratching the surface of Bitcoin’s geopolitical developments since the last Halving. 2021 was a big turning point in moving from a strictly private sector and financial demand, to the public sector and the increasing potential of Bitcoin as a geopolitical weapon to be utilised by Nation States. I cannot give my answer to whether this is the end of boom and bust and the start of the supercycle, before we discuss the legislative progress Bitcoin has made worldwide in the last few years.

Adopting Bitcoin – The Global North and Global South

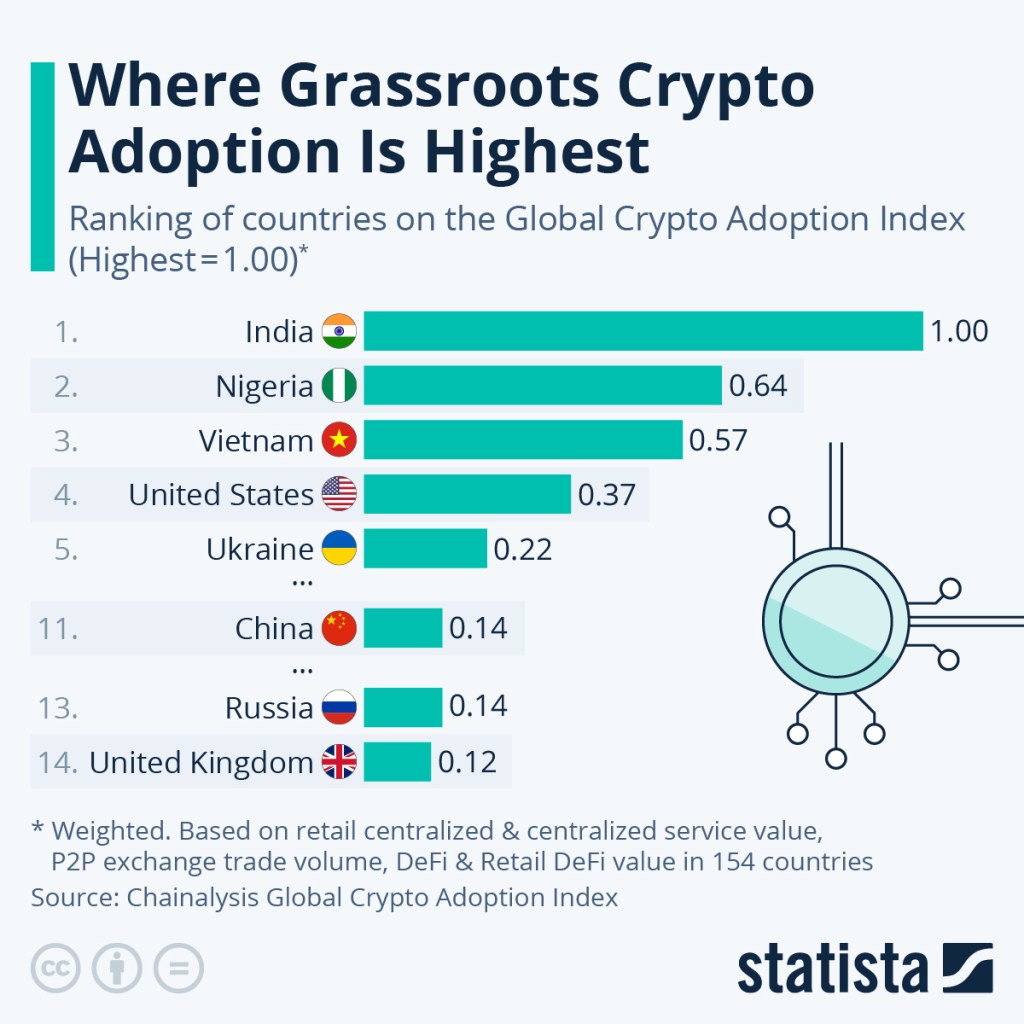

The adoption of crypto-currencies on the whole are spreading fastest in countries with weak national currencies, and under developed banking systems. According to statistics, out of the top twenty countries on the above index, nine are in Asia, three are in South America, and two are in Africa (source)

Most of the geopolitical discussion divides the World between the West and East, but for this section we will divide between the North and South. The North is on the whole developed countries with stable governments and banking/financial systems with relatively high trust levels by their domestic populations and lower cost inflation, including Europe, the UK, the US, Russia and China. The South on the whole are developing countries with less stable governments and financial systems, lower trust among domestic populations and higher cost inflation, including The Middle East, India, Southeast Asia, Africa and South America.

In the Northern countries with more developed financial systems, Bitcoin has developed more as a store of value and a method of saving for the population, while banking remains superior on payment rails and medium of exchange and unit of account at least for the time being. In the Global South where the banking systems are still developing and where sections of the population are under-banked or even unbanked, Bitcoin is developing as a store of value AND the payments system, alongside crypto-currencies more generally, for example stablecoins. It is likely therefore that the Global South will adopt Bitcoin sooner as a payments rail and every day money, than in the Global North where Bitcoin is developing more as collateral and a future foundation for the banking system and payment rails.

Adopting Bitcoin – From the Private Sector to the Public Sector

As already discussed, Bitcoin started from scratch and from the bottom up, the earliest adopters were individuals, businesses and corporations in the private sector, building the exchanges and infrastructure to scale the network to more users, and in a time when national governments and the public sector didn’t know and didn’t care about Bitcoin. As Bitcoin passed its Tenth Birthday in 2019 things started changing in this respect, with National Governments and traditional financial systems waking up to the opportunities and threats of adopting Bitcoin before other countries.

Bitcoin Adoption by Countries

Nayib Bukele, President of El Salvador, the first country to legalise Bitcoin as money (source)

El Salvador with a population of 6.5 million, became the first country to make Bitcoin legal tender on the 7th of September 2021, and the Central African Republic with a population of 5.5 million became the second country on the 27th April 2022. Additionally there is reporting on the islands of Tonga (population of 105,000) and Fiji (population of a million) considering accepting Bitcoin as legal tender to ease their dependence on Western currencies, there is also the case of Panama (population of 4.3 million) where there are clear regulations, and even though Bitcoin is not legal tender, there are no capital gains taxes, putting Bitcoin on the same footing as the US Dollar and the Panamanian Balboa, the official currencies in Panama.

Additionally, acording to recent whispers Suriname (population of 630,000) and Colombia (population of 52 million) in South America are considering a Bitcoin adoption strategy, while the rise of Javier Milei in Argentina (population of 47 million) has led to freedom in using bitcoin to settle contracts, and more importantly has removed all taxes on bitcoin exchange removing governmental barriers, that will fuel domestic adoption of Bitcoin and attract capital and expertise of Bitcoin’s worldwide ecosystem, to flood into Argentina to build the future.

What do the above countries all have in common? They are all developing countries on the periphery of the global financial system, dependent on Dollars and Western currencies, with financial and banking defects that stop the people and the economy from creating and growing capital and wealth, and even more heartbreaking sucking the youth out of these countries into the West to work and send money home. The trend should therefore be clear, politicians in the poorer countries on the peripheries will drive Bitcoin adoption for financial freedom and independence from the West, for the benefit of the future. The likelyhood at the Nation State level is that the developing countries of the South on the peripheries will adopt Bitcoin as legal tender first, and the developed countries of the North at the core will adopt Bitcoin as legal tender last.

Nation States Mining Bitcoin

From the above, and the movement of eight countries containing over 100 million people towards Bitcoin, the question arises of how to conveniently get hold of it? This is another aspect where Bitcoin excels, because bitcoins can be created within the Country by mining and via national electricity grids, that in most of the Countries of the world are in State hands already, one way or another. By diverting state electricity currency can be created domestically, thus strengthening National Security and strengthening independence. For this reason, Bitcoin will become an important part of global geopolitics in the next decade, as discussed at length my Bitcoin and Energy post published April 2023.

Examples of Countries mining Bitcoin:

Iran – Because of Western economic and financial sanctions banning the sale of oil and gas in Dollars to settle trade, Iran has decided to burn its oil and gas into electricity and for mining Bitcoin. Indeed while the Iranian Government has banned Bitcoin mining for the public, after mining operations were established in mosques as receivers of free electricity from the government, Iran is mining on the Nation State level through the Armed Forces, and explicitly with the blessing of the Government. The bitcoins are then used to pay for imports that cannot be paid for in Dollars, and Iran has been mining since at least 2019.

Venezuela – Another Country suffering Western sanctions, after jailing private bitcoin miners in a country where electricity is practically free for the public, Maduro’s Government and the Armed Forces have been mining bitcoin since 2020 to stabilise their financial foundations, as the Bolivar national currency melts in value by the hour in the hands of the public.

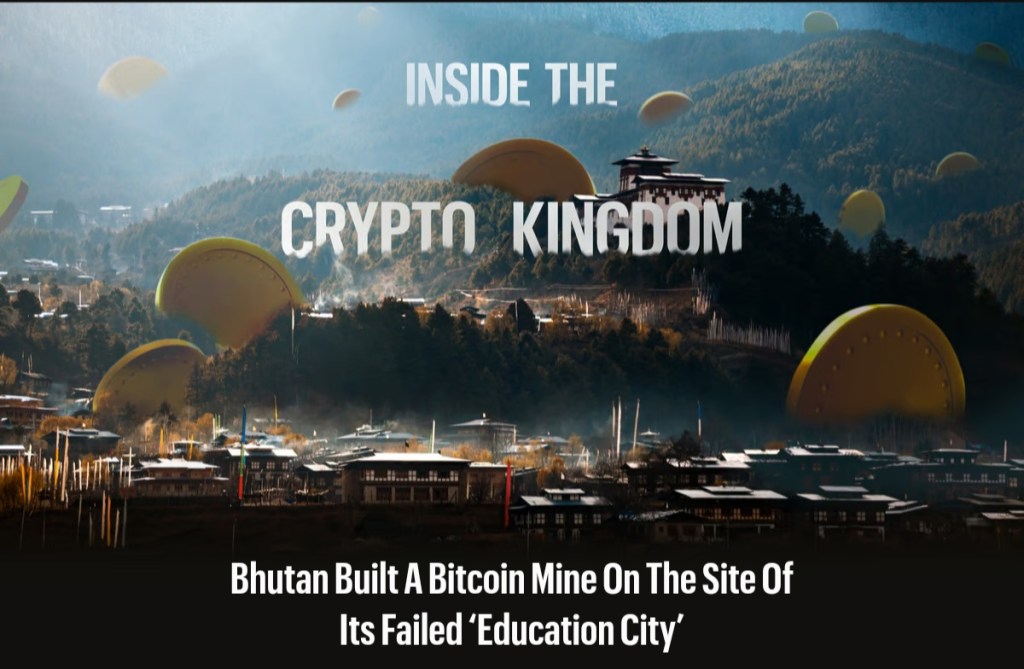

Bhutan – The news came out in only the last few months that the tiny Kingdom of Bhutan, a Nation of 700,000 in South Asia, have been secretly mining since 2020 using renewable energy and hydropower to create electricity. Bhutan’s reasons for adoption of mining on a Nation State level, includes loss of tourism revenues since the Covid catastrophe, and an attempt to stem the flow of emigration of the young out of the Country to work in Western countries for their fiat currencies (1.5% of the population have emigrated to Australia alone in the last two years).

El Salvador – In addition to making Bitcoin legal tender, Bukele has gone a step farther in utilising renewable energy and geothermal heat from volcanoes to mine for bitcoin, for its national treasury and for leveaging debt in the form of Volcano Bonds to build out the country’s Bitcoin infrastructure further.

The four examples above demonstrate how Countries and Governments can produce bitcoins at home, breeding energy and monetary independence from the shortages and perfidy of Western currencies, as the global trust in the Eight Decade Eurodollar System wanes, and its financial sanctions and restrictions on the rest of the world increases. Iran, a country of 88 million, has already turned to Bitcoin to evade sanctions, that has extended to Russia and a country of 147 million people, in the process of legalising Bitcoin as a foreign payments system and rumours that the Government is secretly mining Bitcoin as a strategy to reduce dependence on the EuroDollar in international trade. It should also be clear that Governments can legalise Bitcoin on the State level, while stricly regulating or banning Bitcoin at the Public or individual level, and this is the strongest probability in the short term, that Nations will take advantage of Bitcoin at the international level while stricly regulating Bitcoin’s use as a domestic medium of exchange and payments rail, lest it threaten and undermine the monopoly of their national currencies over the domestic population. But over the longer term, and as the value of Bitcoin increases, it will become a matter of National Security to legalise bitcoin for payments, even considering the mortal threat this would create for the banking and taxation apparatus.

Bitcoin in the West – New Foundations For Western Debt Unions

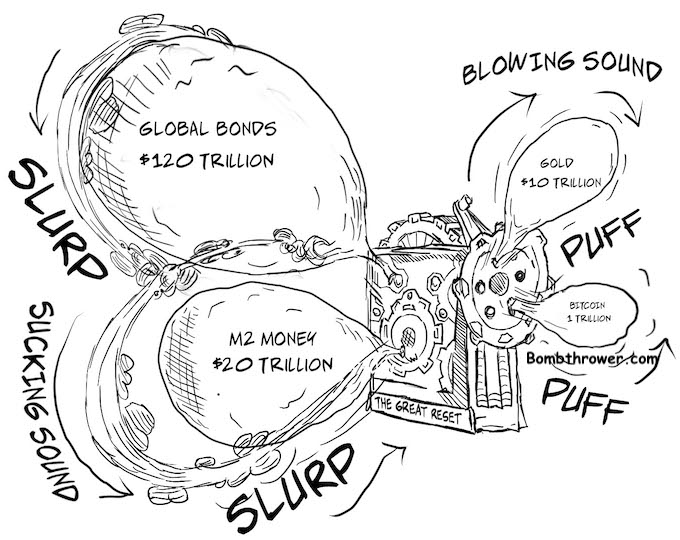

Re-setting global collateral standards will include the revaluation of Gold far higher, with Banks and Governments using Gold and Bitcoin and intrinsic scarcity both physical and digital, as the foundations for a reformed financial system, at the expense of debasing national fiat currencies and government bonds disabling Western Unions and their ability to create debt and government spending (source)

We arrive at the heart of the Global Financial System, and three monetary and fiscal unions that strangle dominate trade settlement over the world. Despite the neverending and nightmarish debts the United States, the European Union, and the United Kingdom have created since their inception, inflation and debasement is generally lower in these currencies and the banking and payments systems operate more efficiently, meaning the probability that it will take longer for Bitcoin to take over as a payment network, but Bitcoin offers far more short term value for the West as a store of value and scarce and valuable collateral to back the debts currency and treasury.

2008 was the peak of trust in the EuroDollar Financial System – ever since the world’s Central Banks have been preparing for a change in the financial order. Gradually, then suddenly.

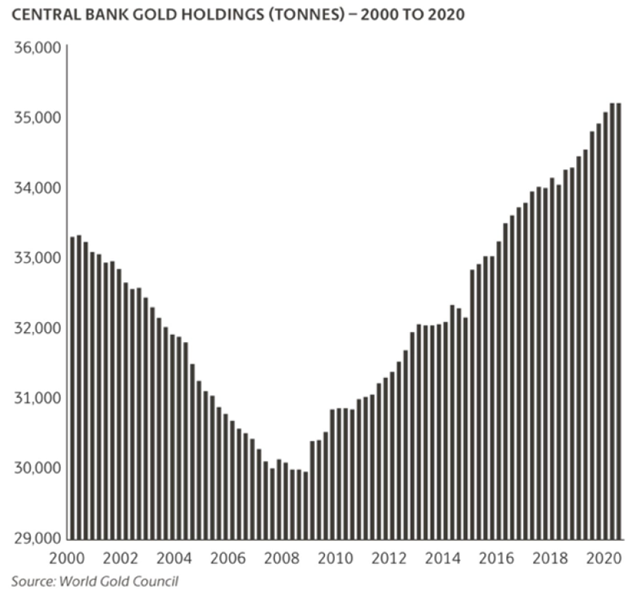

Because of Gold’s historical role as foundations of the old monetary and banking system, and for the simple fact that the Central Banks of the World still hold gold on their balance sheets as independent and sovereign collateral, then it is relatively easy to predict that the Western Debt Unions, amidst the collapse of their international bond and debt markets, and increasing domestic inflation and currency debasement, will decide to revalue their gold reserves higher and through the fraud magic of Accounting, will revalue their balance sheets higher, and increase the demand for gold buying and storage in the West.

Latest Bitcoin to gold exchange and market cap, courtesy of Clark Moody’s Bitcoin Dashboard

What is true for Gold, is true for Bitcoin. If the Banking System and National Governments begin creating Bitcoin Treasuries as a foundational asset on their ledgers, as the price and value of Bitcoin rises to does the value of the collateral underpinning banking and treasuries increases, allowing the banks to increase loans and “economic growth”, increasing the tax take and government spending on the liabilities side. The price that will have to be paid for revaluing superior collateral in Gold and Bitcoin higher, is by debasing the value of national debt lower, making Western debt undesirable to the rest of the world, disabling out of control Government spending and trade deficits, but this price will be worth paying compared to financial and debt crises and higher inflation and currency debasement.

Western Banks Adopting Bitcoin

We begin with the unelected financial bureaucracies that supervise the world’s Central Banks. The Bank for International Settlements is recognised as the Central Bank of Central Banks, with its god awful ugly headquarters in Basle, Switzerland, and its Committees decide capital and collateral standards for the global banking system, so it’s important to pay attention to regulatory developments in crypto-currencies at this level.

Basel Committee Finalises Policy Suggesting 2% Exposure Cap For Banks. With approximately $180 TRILLION under custody, 2% would be roughly $3.6 TRILLION, nearly 3X Bitcoin’s current market of $1.3 Trillion (Source)

The Basel III Accord, is the latest framework that sets international standards for bank capital adequacy, stress testing, and liquidity requirements, and is intended to strengthen bank capital requirements by increasing minimum capital requirements, holdings of high quality liquid assets, and decreasing bank leverage.

It is Basel III that promoted physical and allocated gold to Tier 1 Capital, in December 2022 the Basel Committee on Banking Supervision (BCBS) finalised its proposed policy on hodling Bitcoin, after consulting with banking lobbies (including J P Morgan and Deutsche Bank), a limit of 2% of Tier 1 capital in Bitcoin. Based on $180 trillion in bank capital, 2% would be around $3.6 Trillion.

While the above does not mean that all the world’s banks are about to flood into Bitcoin in the near future, the door has been opened, by the banks themselves, into holding Bitcoin as collateral on their balance sheets. For example, if the price of Bitcoin were to increase 10X from here, 2% would multiply to 20% of balance sheet capacity, and ten times the capacity for banks to issue loans and the economic growth that would follow in its wake.

Updating Accounting Standards for Bitcoin

As well as Banking Accords that define capital allocation and balance sheet composition of the global private banking network, there is also the institutional side to explore, covering pension funds, insurance funds, mutual funds, money market funds, exchange traded funds, and the whole corporate space in general. Institutions, like banks are heavily regulated in what they can and can’t invest in, their hands are tied to accounting standards and the world of bean-counting.

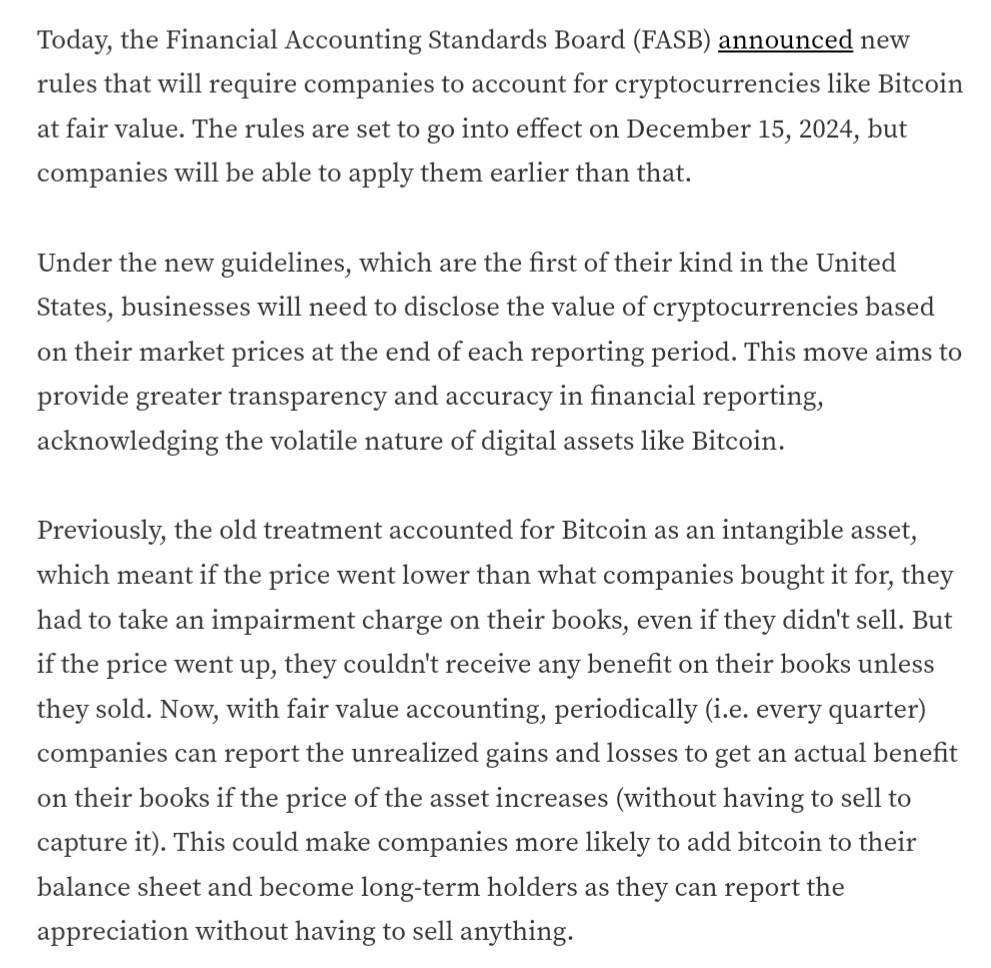

While there are many institutions already investing and invested in Bitcoin, there are accounting penalties and disincentives for doing so at present, holding Bitcoin as a balance sheet asset for example under current GAAP Policy is classed as an indefinite-lived intangible asset, which has only downsides for Bitcoin in balance sheet accounting. If Bitcoin falls during a quarter, the company must recognise the impairment charge if the fair value decreases at any point below the carrying value, however if Bitcoin increases this is not recognised as a gain nor reflected in the asset’s carrying value on the balance sheet.

This ludicrous designation as indefinite-lived intangible asset, that thas inhibited institutional investment in Bitcoin on corporate books is now set to be revised, as the Financial Accounting Standards Board (FASB) moves forward to fair value accounting for Bitcoin.

FASB is the private standard-setting body whose primary purpose is to establish and improve Generally Accepted Accounting Principles (GAAP) within the United States in the public’s interest. The Securities and Exchange Commission (SEC) designated the FASB as the organisation responsible for setting accounting standards for public companies in the U.S…

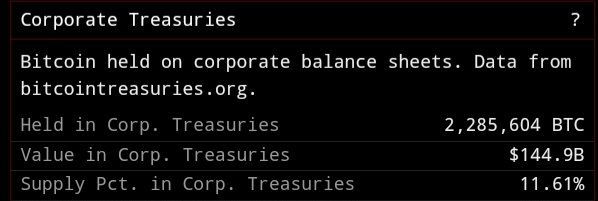

This one accounting tweak has huge ramifications for Bitcoin’s future, as the US and the world’s most financialised economy adopts fair value accounting, it forces Accounting Standard Boards in other countries to take the same stance towards Bitcoin as a treasury reserve asset, allowing their private companies to buy into the Bitcoin Accounting Standard… From now on companies holding bitcoins on balance sheets can mark to market every quarter at fair value, the increasing value of Bitcoin increases the value of institutional balance sheets and the company’s financial health, allowing it to expand operations and growth for the future… And because bitcoin’s issue schedule is completely predictable and halving every four years, all these institutions will be scrambling for a share of the 21,000,000 maximum cap, of which nearly 20 million have already been mined and with the issue schedule to halve again shortly from 900 per day to 450 per day, will drive a demand for Bitcoin that far outstrips supply, I argue a persistent and insatiable institutional bid for Bitcoin could abolish the four yearly boom and bust cycles that have repeated three times since the 2009 inception… The liquidity unleashed into Bitcoin is sure to reduce its volatility, which increases stability against Bitcoin’s wayward price swings, that would make bitcoin even more desirable as a reserve asset and collateral to hold, contributing further to the feeding frenzy that revalues the whole balance sheet and solvency of corporate America and beyond even higher still! Just take some time to think about that…

Bitcoin corporate treasuries currently at $144.9 Billion, 2,285,000 bitcoins, or 11.6% of supply, according to bitcointreasuries.net, courtesy of Clark Moody’s Bitcoin Dashboard…

Bitcoin Adoption by Western Governments – Parliamentary Laws

In addition to the unelected private bureaucracy and supervisory bodies, there are also public and elected bodies and the Laws of the Land, Parliamentary Laws and Politicians will have a bigger influence on the future of National Bitcoin adoption.

To discuss the West and the beating heart of the EuroDollar global banking network, against all expectations, the European Union have taken the lead with Markets in Crypto Assets – MICA signed into Law since the 20th April 2023, and to mixed reviews. Even so, European companies and banks now a have a far clear picture of what is and what is not possible with Bitcoin, with Germany’s largest bank, Deutsche Bank one of the earliest movers offering crypto custody to its clients.

After looking as the most promising Union for adopting Bitcoin under the Presidency of Donald Trump, the United States have fallen to the back of the class in the Presidency of Joe Biden and the Democrats, their obvious hated of Bitcoin out in public, and strongly influenced Operation Chokepoint 2.0 and the mildly successful attempt to starve Bitcoin Exchanges and Crypto-Banks from the TradFi Sector. Despite the efforts of the Democrats, on Wall Street the financial system continues to warm with the dozen new ETF’s launched in January 2024 by some of the world’s biggest companies such as BlackRock and JP Morgan, showing an increasing appetite to invest. Even within Congress, there are Crypto Bills working their way through the legislative swamp, from the bipartisan Lummis-Gillibrand S. 4356 Responsible Financial Innovation Act – RFIA since July 2022, the Market Structure draft bill and Clarity for Payment Stablecoins Act 2023, by the Chair of the Financial Services Committee, Patrick McHenry and Republican House of Representatives Members, as the US falls behind in Bitcoin adoption and dependent on the second coming of Trump, and a Republican landslide in Congress in November.

Lastly to London, where the Financial Services and Markets Act 2023 passed into Law, for regulating the crypto-currency sector. The lobbies of the Treasury, the Bank of England and the Financial Conduct Authority will consult with remaining lobbies in the private and public sector, that will decide the extent and the speed at which Britain will financialise Bitcoin.

MY ANSWER: The Bitcoin Supercycle – The End of Boom and Bust?

The proponents for the Suercycle have their strongest case yet, predictions in 2017 and 2021 were wildly optimistic and premature compared to the actual scale of Bitcoin financialisation based on immature first and second generation exchanges, and little legal clarity by National Governments, especially the Western Financial system that controls the levers of power over the rest of the world. As detailed above, today we have the World’s biggest financial centres approving ETF’s, banking accords and accounting revisions that are opening up Bitcoin to bank and corporate balance sheets, Bitcoin is legal tender in two countries already and could be in two or three more countries in the next couple of years, reducing tax rates and barriers to domestic hyperbitcoinisation, countries mining bitcoin as a national treasury and for international trade settlement, and the regulatory fog is clearing in the West that will guide bitcoin businesses and capital in their decision whether to stay within the West, or move to other more friendly jurisdictions outside the West.

We are clearly increasing in scale in terms of the disruption and adoption of Bitcoin worldwide, which means the spigots of legacy finance and banking are opening up to let what could become a tidal flow of fiat money to continue to pump up Bitcoin’s value and price forever more, invalidating the price predictions I have just made based on the last Bull Market cycle. Just consider this for a moment, if Bitcoin goes 10X from this halving to the next as it has since 2020, and as 2020 was 10X from 2016, at the halving in early 2028 Bitcoin would need to be at $650,000!!! Considering the scale of adoption that Bitcoin now possesses in the connection with the TradFi system on corporate, banking and parliamentary level, that figure does not seem crazy to me, but it would make another complete mockery of my price predictions, this time too conservative and low. Only time will tell.

While the scale of Bitcoin monetisation may take it a lot higher than most analysts expect in this cycle, I do think that there will still be a cycle, and a likely downdraft in 2026 to over-correct the excesses of 2025. Due to monetisation, this downdraft may not reach 80% like the last two cycles, as the increasing liquidy flowing into Bitcoin on distributed exchanges worldwide will reduce its volatility, and at least lessen the effect of the boom and bust cycle in 2025 and 2026. Having been invested in Bitcoin for over a decade, I have come to the realisation that the boom and bust cycle may be a feature rather than a bug, at least prior to hyperbitcoinisation, because Bitcoin is a scarce ledger and its currency is a limited resource, it suffers from scaling pressures. When I was cheerleading Bitcoin’s ascent to world domination in 2015 a guy told me on Twitter that if Bitcoin grew too fast it would break and be unusable for everybody, and would need to be adopted in waves, and that description has stayed with me. So the bull cycle is the period when everyone is talking about and buying into bitcoin, leverage is cranking up on exchanges and from degens who are gambling with money they don’t have, exchanges receive massive inflows and explosion in trading revenues and fees, and there is a growth surge in users, miners and developers, who want to invest in the accounting standard of the future, and all this naturally shows up in Bitcoin’s mempool, in congestion and exploding cost of transaction fees.

The blow off top bull market is the year I feel most uneasy, and when Bitcoin hits its scaling limits hard, in blockspace and in financialisation. The benefit of exploding transaction congestion and fees is it pressures and forces new scaling solutions by concentrating minds, and brings more possible consensus on upgrades in throughput, likely this time around will converge on some version of covenants, that promise utxo sharing, allowing more hodlers to be able to self custody, as utxo’s become an ever more scarce resource. But what has repeated in every halving cycle so far is that there is natural respite from all the growing pains and pressure because for whatever reason Bitcoin cannot sustain the massive increases indefinitely, at some point the sellers overpower buyers, leverage is flushed and degens are carried out feet first on stretchers, and exchange transaction revenues and fees dry up, and what has gone up in the last year must come down in the next year.

The bear market is the respite for Bitcoin. As price falls, public interest drops, leverage dwindles, and onchain transactions and fees subside, the mania dissipates, and bottlenecks ease. In short Bitcoin developers get far less distractions in a bear market, and they have gained and benefitted from all the chaos of the previous year, in identifying and working on solutions for scaling pressures, possible soft fork upgrades that can now start being built out quietly, to ironing out bugs and upgrading bitcoin to scale for the next bull market. In addition, the bear market year aids in the creative destruction of most if not all the profligacy and mis-allocation of capital and resources created during the bull market in the user, miner and exchange space. The most overleveraged and undercapitalised miners and exchanges usually blow up in the early stages of the bear market, as Bitcoin drops so does the commodity and collateral that underpins their balance sheets, as we saw in 2022 with miners and exchanges, bankrupting the weak and over extended, and handing over their assets to the strong and prudent, the same as any traditional boom and bust financial and business cycle.

The same is true for the users. The leveraged are flushed out first, followed by gamblers and paper hands speculators, just in it for the quick buck. The bear market will continue to grind lower down around 80% from the high that will progressively force the weak willed to sell, and as their coins are slowly redistributed to the strong hands. Using the law of Pareto Distribution aka the 80/20 Rule, 80% of newbies who invested in Bitcoin during the bull market will be flushed out during the bear market, but will leave a new 20% cohort of hardcore hodlers forged in the blazing fires of an 80% drawdown, and this remaining 20% will be added to the existing 80% of hodlers from previous cycles. Losing money is the most painful feeling for any investor and Bitcoin tests your will like no other asset, making hodlers far more hardened and anti-fragile than TradFi investors who would soil themselves at such volatility and price swings. Everyone who can make it through the bear market will reap the gains of the next bull market, and got a cheap year in which to stay humble and stack sats.

The red year is the cheapest to stack (source)

It seems to me that Bitcoin’s adoption waves that have repeated the last three times, are necessary at this early point in its history for Bitcoin to sustainably scale with a strong and hardened user, miner and exchange base, and a cycle that has been forgotten the last 15 years in the TradFi sector, due to Central Bank manipulations and bank bailouts that entrench corrupt and weak powers while stifling competition for new and lean competitors. For this reason, I expect another boom and bust cycle to repeat this, so my longwinded answer to the question is no!

Conclusion

As we pass into Bitcoin’s Fifth Halving Epoch we have reached a very interesting point in time, four years since the Covid lockdowns that blew up the world’s supply chains, morphing from the initial energy crisis into a financial crisis and worldwide recession, further fracturing and de-globalising finance and trade, creating huge inflationary cost pressures, and will undermine government debt loads and the collateral underpinning the post WWII Eurodollar global financial system, that will in turn require new forms of scarce and appreciating neutral collateral, in gold and Bitcoin. The revaluation of gold will be politically induced, by the dismantling of the futures based gold price setting and possibly back to gold fixing or a more market based pricing system, but cannot be predicted. Bitcoin is somewhat more predictable, in its fifth halving cycle with the block subsidy dropping to 3.125 bitcoins every ten minutes (450 per day)… Every previous halving (Nov 2012, July 2016, May 2020, April 2024) and the quantitative tightening of bitcoin emission, has led to a surge in the Bitcoin price in the eighteen months following, with cycle peaks in December 2013, December 2017, and November 2021, which gives us an estimated cycle peak this time around at year end 2025, or nineteen months away and Bitcoin’s fifth major bull market in price and value that will take it into the hundreds of thousands in fiat dollars, pounds and euros, probably due to institutional and nation state adoption.

Happy Halving and we will reconvene in 2028!

Will this time be different? Somehow, I doubt it!

Bitcoin Donations Gratefully Accepted:

bc1q49a3y9anq3a2pjqvq3gm8wj8aqqld3pnva9phwna2ftdar73mf3qak275j